- Joey Choy Top Stocks

- Posts

- AAPL Hits New Highs — Still Time to Ride the Trend?

AAPL Hits New Highs — Still Time to Ride the Trend?

Momentum, structure, and trend all point higher, here’s the next level to watch

Executive Summary

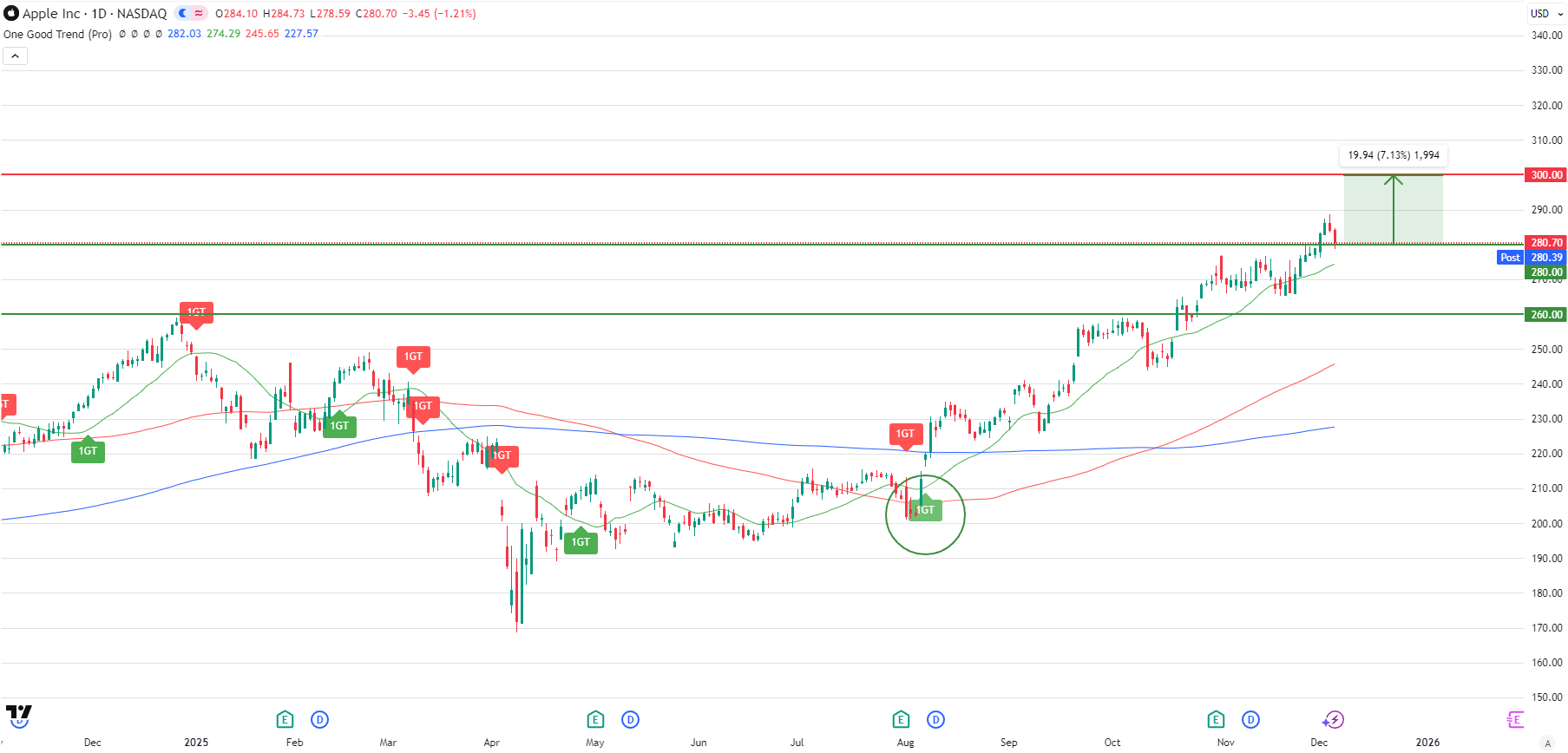

Apple (AAPL) has fired another bullish signal just as it broke above a key resistance level at $280, which is now on track toward the psychological $300 mark. Backed by strong price structure, a rising trend, and active 1GT momentum, the chart suggests there may still be room to ride this move higher. Even with leadership shifts in Apple’s AI division, investors appear to be looking past the headlines and focusing on the price action.

In this article, I apply my One Good Trend (1GT) strategy to break down the current setup, highlight the price zones that matter now, and explain why this breakout could still have legs. Whether you’re looking to re-enter or catch the next wave early, I’ll show you how to potentially amplify your returns using DLCs, especially with the uptrend still firmly intact.

Apple Inc (AAPL.NQ)

Apple Inc. (NASDAQ: AAPL) is one of the world’s most valuable and iconic technology companies, with businesses spanning smartphones, wearables, services, and computing hardware. A core member of the US “Magnificent 7,” it remains one of the most liquid and closely watched stocks globally.

Since bottoming out in April 2025, AAPL has staged a strong recovery, climbing more than 60% and regaining its leadership position within the broader US market.

Most recently, a bullish 1GT signal was triggered in early August and that signal has been playing out cleanly ever since.

The uptrend remains firmly intact with no exit signal in sight. Using the One Good Trend (1GT) strategy, this is a textbook bullish setup.

The 20-day moving average (green line) has held above the 100-day (red) and 200-day (blue) moving averages since the end of August, confirming strong short-term momentum.

The longer-term structure is also intact, with the 100-day sloping upward and staying above the 200-day, which is a positive sign for uptrend continuity.

After consolidating near $280 in November, price has now broken out and surged above this key level, turning that zone to become the immediate support.

The next potential upside target sits at the psychological $300 level, where some profit-taking could return.

As long as AAPL stays above the new higher support of $280, the current uptrend remains valid.

Should a controlled pullback occur, the zone near support around $280–$285 range could offer opportunities for traders looking to ride the momentum.

Below that, $260 would be the stronger support to watch, where price previously consolidated before this breakout.

The bullish 1GT signal from August remains active and there has been no red (bearish) signal to invalidate the trend.

Note that a new green signal appearing near current levels would provide added confirmation of continued strength.

So, how does one take a position in Apple whereby you are able to reap more potential return to ride either the downside or upside further?

Those keen to ride on the short-term upward momentum in AAPL shares can consider using Daily Leverage Certificates (DLCs) traded on SGX to leverage on that move.

The reason for that is that the DLCs can potentially generate magnified returns for a given move in the underlying.

You can trade in both Long or Short directions and in SGD trading currency during Asian market hours, even when the US markets are closed.

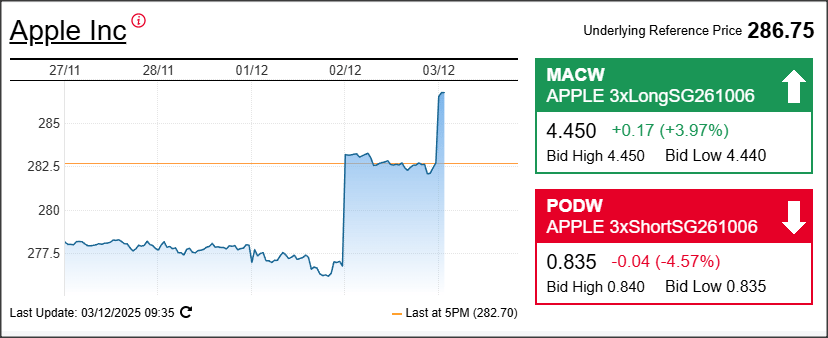

Traders who are bullish can consider the 3x Long DLC on AAPL (MACW), while those who are bearish can consider the 3x Short DLC (PODW) as shown below.

Source: https://dlc.socgen.com/en/usdlc

(The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance)

Magnificent 7 US Stock DLCs

Those keen to ride the short-term momentum in AAPL can consider using Daily Leverage Certificates (DLCs) listed on SGX to amplify their exposure.

The US Stock DLCs are designed to provide a fixed 3 times leverage performance on the underlying US stock daily performance on a US market close-to-close basis. The basic principle of the daily performance is as follows:

If AAPL rises by 2%, the respective 3x Long DLC will rise by 6% and 3x Short DLC will fall by 6% accordingly on a US market close-to-close basis, before overnight cost and fees.

If AAPL falls by 2%, the respective 3x Short DLC will rise by 6% and 3x Long DLC will fall by 6% accordingly on a US market close-to-close basis, before overnight cost and fees.

Investors can trade the US Stock DLCs during SGX market hours 9:00AM to 5:00PM via any regular stock brokerage account where Societe Generale as the Designated Market Maker will provide live tradable prices and intra-day liquidity, offering investors a new trading window during Asian hours when US markets are closed.

Visit DLC.socgen.com/usdlc to find out more.

About the Author - Joey Choy

Joey is Singapore’s renowned mentor on how to make an income by trading the stock market, an author and one of the most-watched, quoted and followed stock trading trainers in Singapore. Over the years, he has conducted numerous full house seminars, enriching thousands to trade more profitably.

Joey’s come back story from a S$740k debt has been featured in the Business Times and inspired thousands in Singapore. In less than 3 years, he is highly regarded as one of the Top Tier Remisiers (Stock Brokers) and Traders, bagging numerous yearly awards like Top Trading Representative and Top CFD Achiever every year from 2014 to 2023 in Phillip Securities.

More about Joey here

Hope you have found the above content useful 😃

If you are keen to find out more on how to be a VIP Client of mine to receive daily market updates and exclusive actionable stock ideas, you can check it out here!

Look forward to see you on the inside!

- Joey

Disclaimer and Warning

This publication is provided by Joey Choy for general information and educational purposes only.

This content has been produced by Joey Choy. Singapore Exchange Limited (“SGX”) and/or its affiliates (collectively with SGX, the “SGX Group Companies”) have not had any input into this publication and/or the content, and SGX shall not be responsible or liable for the same.

This document/material is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document/material has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Use of and/or reliance on this document/material is entirely at the reader’s own risk. Joey Choy shall not be liable for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here.

Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Any forecast, prediction or projection in this document/material is not necessarily indicative of the future or likely performance of the product. Examples (if any) provided are for illustrative purposes only.

This document/material is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject the SGX Group Companies to any registration or licensing requirement.

While each of the SGX Group Companies have taken reasonable care to ensure the accuracy and completeness of the information provided, each of the SGX Group Companies disclaims any and all guarantees, representations and warranties, expressed or implied, in relation to this document/material and shall not be responsible or liable (whether under contract, tort (including negligence) or otherwise) for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind, including without limitation loss of profit, loss of reputation and loss of opportunity) suffered or incurred by any person due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information, or arising from and/or in connection with this document/material.

The information in this document/material may have been obtained via third party sources and which have not been independently verified by any SGX Group Company. No SGX Group Company endorses or shall be liable for the content of information provided by third parties (if any). The SGX Group Companies may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Each of SGX, Singapore Exchange Securities Trading Limited and Singapore Exchange Bond Trading Pte. Ltd. is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document/material is subject to change without notice. This document/material shall not be reproduced, republished, uploaded, linked, posted, transmitted, adapted, copied, translated, modified, edited or otherwise displayed or distributed in any manner without SGX’s prior written consent. Please note that the general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document/material.

This article was created in partnership with Societe Generale (Singapore branch). This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see http://www.dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.