- Joey Choy Top Stocks

- Posts

- China’s Rebound Gains Steam, These 3 HK Giants Are Breaking Out

China’s Rebound Gains Steam, These 3 HK Giants Are Breaking Out

Strong chart signals and macro tailwinds, see which 3 HK blue chips are setting up.

Executive Summary

China’s industrial engine is roaring back to life. September saw industrial profits surge 21.6% year-on-year, the strongest monthly jump in nearly two years. Behind that are Beijing’s recent policy efforts to rein in price wars, stabilize producer margins, and redirect capital toward high-tech manufacturing. As profitability and output rebound, market sentiment is turning cautiously optimistic, and capital is flowing into HK-listed blue chips.

Right now, we’re seeing early confirmation of that optimism on the charts. Three heavyweight HK stocks, PetroChina, Bank of China, and Ping An, have just flashed fresh 1GT (Pro) bullish signals.

Even better? You don’t need a foreign brokerage to ride them. All three are available as HK SDRs listed on SGX, tradable in SGD, with tight spreads and clean exposure to China’s uptrend.

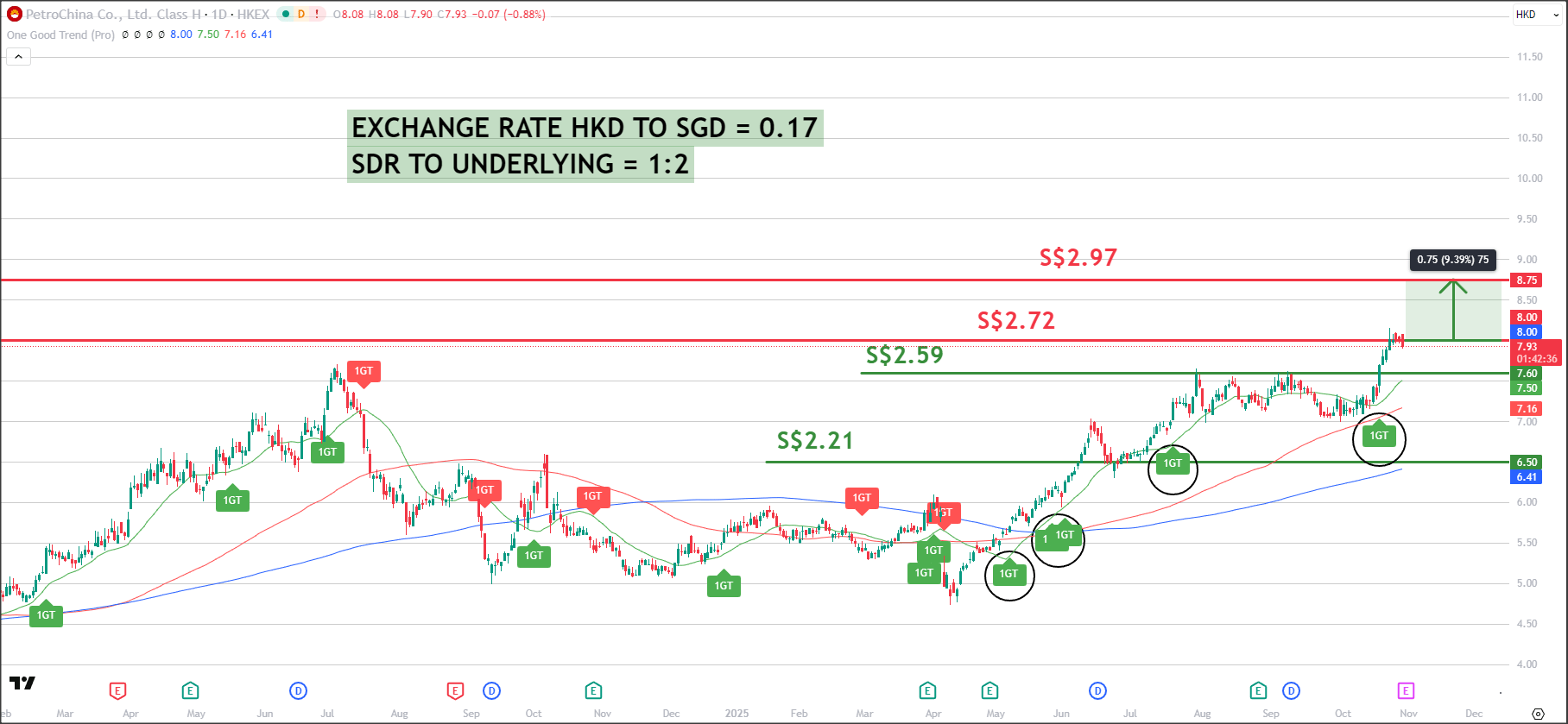

1) PetrolChina Co Ltd (0857.HK), SMIC HK SDR 1to2 (HPCD)

PetroChina (0857.HK), China’s largest oil and gas producer, continues to show signs of strength amid improving energy market sentiment and a rebound in oil-related counters. From a technical perspective, the chart is showing a healthy uptrend with strong momentum recently returning.

The stock is now trading firmly above all its key moving averages, 20-day, 100-day, and 200-day, which are all positively sloped. This alignment confirms that the longer-term trend remains intact and bullish. Over the past six months, multiple 1GT bullish signals have emerged, especially from May to Jun, the most recent 1GT bullish Signal appeared Mid October. Each signal led to a successful push higher, forming a series of higher lows and higher highs.

A fresh 1GT (Pro) bullish signal was triggered recently as the price broke above the S$2.59 resistance (HK$7.60). The current breakout now opens the door to further upside, with the next potential resistance coming in at S$2.72 (HK$8.00), followed by S$2.97 (HK$8.75) if momentum continues.

💡 So how does one take a position in PetroChina from the HK SDR traded on the SGX?

This stock is available via the PetroChina SDR listed on SGX, with the name “PetroCN HK SDR 1to2” (Ticker: HPCD), and an SDR-to-underlying ratio of 1 SDR to 2 shares. Based on the 0.17 HKD to SGD exchange rate, the SDR is currently priced around S$2.68.

Conservative traders may look to accumulate near the S$2.59 zone, with a stop just below the 100-day MA (S$2.43, HK$7.15).

More aggressive entries may ride the current breakout, trading the S$2.72 (HK$8.00)– S$2.97 (HK$8.75) range.

2) Bank of China Ltd (3988.HK), Bank of China HK SDR 1to1 (HBND)

Bank of China (3988.HK) continues to be one of the most widely followed state-owned financial institutions in Hong Kong, especially for yield-seeking investors and those watching for macroeconomic turns. After months of downward drift, the technical picture has just flipped to a more constructive tone.

Most notably, a new bullish 1GT (Pro) signal flashed late October as price broke above the S$0.75 (HK$4.40) resistance, turning into a new support level. Although the 100-day moving average is currently still sloping down, the 200-day moving average continues to point up, showing long-term strength. The 20-day moving average has also started to point up, showing early signs of buying momentum.

The S$0.75 (HK$4.40) support zone is currently being tested and still holding up. And with momentum now picking up, the next upside targets lie at S$0.82 (HK$4.80), where sellers previously stepped in, with a higher target at S$0.88 (HK$5.20) if S$0.82 (HK$4.80) gives way. The stock still trades below its mid-year highs, which offers room for a potential reversion move if bullish conditions continue.

💡 So how does one take a position in Bank of China from the HK SDR traded on the SGX?

You can take a position via the Bank of China HK SDR 1to1 (Ticker: HBND), which trades on the SGX with a 1 SDR to 1 share ratio. Using the 0.17 HKD-to-SGD exchange rate, the SDR is currently priced around S$0.73 - S$0.75, mirroring the underlying chart structure.

Conservative traders might prefer to wait for a clearer breakout above S$0.75 (HK$4.40) to confirm strength.

Aggressive traders may accumulate early, riding the momentum up to the next resistance of S$0.82 (HK$4.80), with a stop under the S$0.75 (HK$4.40) support.

3) Ping An Insurance (2318.HK), Ping An Ins HK SDR 2to1 (HPAD)

Ping An Insurance (2318.HK), one of China’s largest insurance and financial services providers, is starting to turn heads again as it builds a solid base near recent support. With exposure to life insurance, banking, and asset management, the stock remains a proxy for China's middle-class financial growth.

From a technical perspective, Ping An is consolidating just under the key resistance at S$4.93 (HK$58.00), where previously 1GT bearish signal showed up as profit taking came in. Renewed strength once again appeared at the support of S$4.42 (HK$52.00). This same level has repeatedly acted as a springboard for past rallies towards the $4.93 (HK$58.00) level.

Upside resistance levels to monitor are S$4.93 (HK$58.00) and next target at S$5.44 (HK$64.00), both of which represent logical targets if momentum builds. The trend of higher lows and continued support along the 100-day moving average suggests the longer-term structure remains bullish.

💡 So how does one take a position in Ping An Insurance from the HK SDR traded on the SGX?

To take a position via the Ping An Ins HK SDR (Ticker: HPAD), which is listed on the SGX, note that it trades with a 2 SDR to 1 share ratio. Based on a 0.17 HKD-to-SGD exchange rate, the SDR is currently priced around S$4.65 - S$4.70.

Conservative entries could build positions on dips near S$4.42 (HK$52.00), which is the recent lows.

Aggressive entries may consider waiting for a confirmed breakout above S$4.93 (HK$58.00), with a stop below the S$4.93 (HK$58.00) level if it is not able to hold.

About the Author - Joey Choy

Joey is Singapore’s renowned mentor on how to make an income by trading the stock market, an author and one of the most-watched, quoted and followed stock trading trainers in Singapore. Over the years, he has conducted numerous full house seminars, enriching thousands to trade more profitably.

Joey’s come back story from a S$740k debt has been featured in the Business Times and inspired thousands in Singapore. In less than 3 years, he is highly regarded as one of the Top Tier Remisiers (Stock Brokers) and Traders, bagging numerous yearly awards like Top Trading Representative and Top CFD Achiever every year from 2014 to 2023 in Phillip Securities.

More about Joey here

Hope you have found the above content useful 😃

If you are keen to find out more on how to be a VIP Client of mine to receive daily market updates and exclusive actionable stock ideas, you can check it out here!

Look forward to see you on the inside!

- Joey

Disclaimer and Warning

This publication is provided by Trading Impossible Pte Ltd for general information and educational purposes only. Trading Impossible Pte Ltd is NOT licensed or regulated for the provision of investment or financial advice, and we do not seek to do so.

This content has been produced by Trading Impossible Pte Ltd. Singapore Exchange Limited (“SGX”) and/or its affiliates (collectively with SGX, the “SGX Group Companies”) have not had any input into this publication and/or the content, and SGX shall not be responsible or liable for the same. This document/material is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document/material has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Use of and/or reliance on this document/material is entirely at the reader’s own risk. Trading Impossible Pte Ltd shall not be liable for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Any forecast, prediction or projection in this document/material is not necessarily indicative of the future or likely performance of the product. Examples (if any) provided are for illustrative purposes only. This document/material is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject the SGX Group Companies to any registration or licensing requirement. While each of the SGX Group Companies have taken reasonable care to ensure the accuracy and completeness of the information provided, each of the SGX Group Companies disclaims any and all guarantees, representations and warranties, expressed or implied, in relation to this document/material and shall not be responsible or liable (whether under contract, tort (including negligence) or otherwise) for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind, including without limitation loss of profit, loss of reputation and loss of opportunity) suffered or incurred by any person due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information, or arising from and/or in connection with this document/material. The information in this document/material may have been obtained via third party sources and which have not been independently verified by any SGX Group Company. No SGX Group Company endorses or shall be liable for the content of information provided by third parties (if any). The SGX Group Companies may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Each of SGX, Singapore Exchange Securities Trading Limited and Singapore Exchange Bond Trading Pte. Ltd. is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document/material is subject to change without notice. This document/material shall not be reproduced, republished, uploaded, linked, posted, transmitted, adapted, copied, translated, modified, edited or otherwise displayed or distributed in any manner without SGX’s prior written consent. Please note that the general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document/material.