- Joey Choy Top Stocks

- Posts

- December 2025 Newsletter

December 2025 Newsletter

Market Updates and Top Stock Picks from Singapore & US market

Hello everyone,

As we head into December, markets are ending the year on a choppy note. After hitting record levels earlier in 2025, U.S. indices have swung more sharply in November as investors juggle AI “bubble” worries, profit-taking in big tech, and uncertainty over the next Fed move. Closer to home, the STI has also eased slightly after reaching new highs, but overall 2025 has still been a strong year for Singapore equities, especially for quality names with solid earnings and cash flow.

On a more personal note, thank you for all your support in 2025, for reading these newsletters, showing up for our AMAS sessions, and trusting my team and me through the ups and downs. It’s been an exciting year for markets, and I’m very grateful we’ve been navigating it together. Happy Holidays!

Your No.1 Fan,

Joey Choy

Market Overview

Singapore

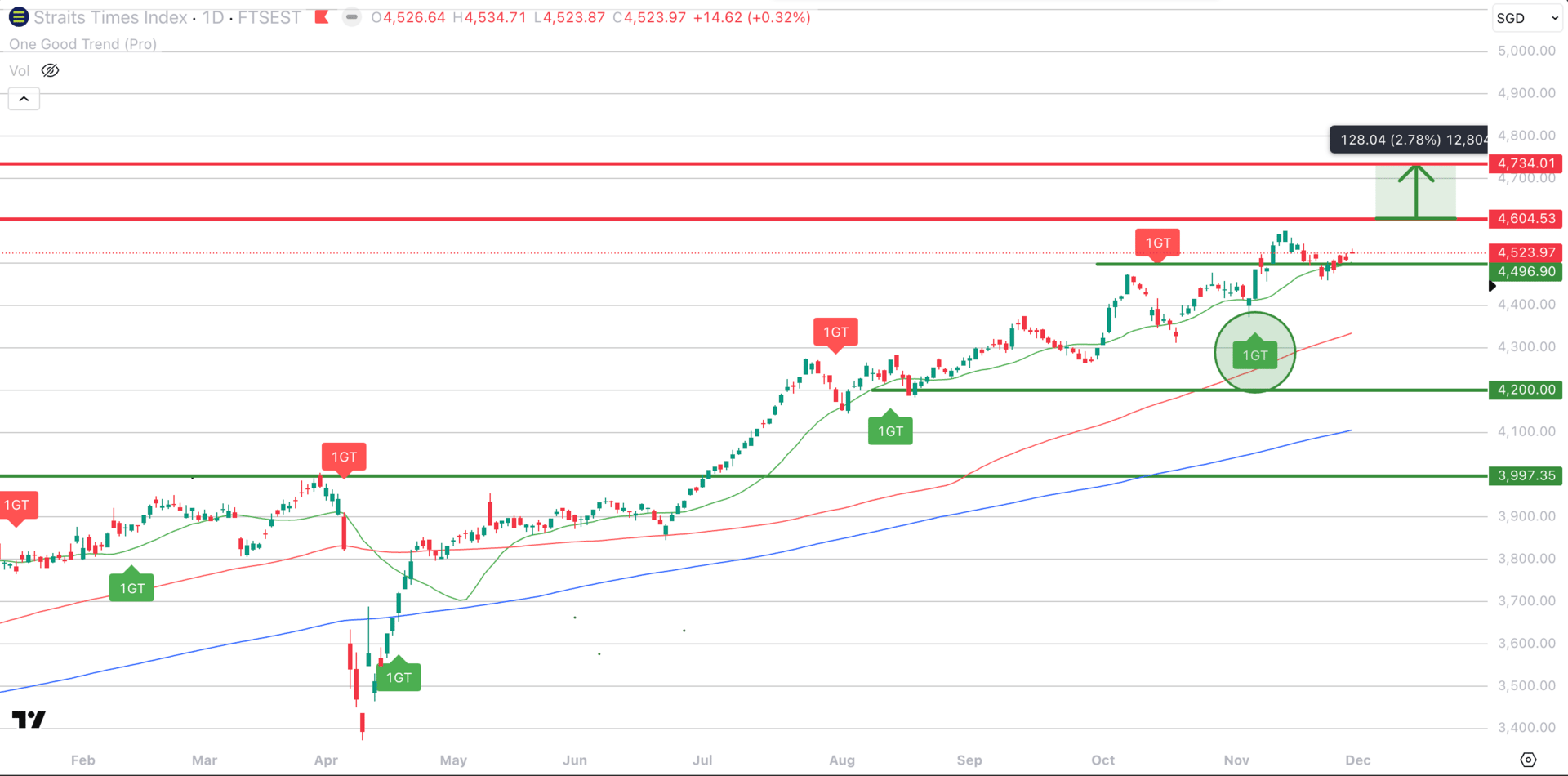

Straits Times Index (TradingView)

Straits Times Index (STI) is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

On the macro front, the story has turned more positive. The government upgraded 2025 GDP growth to “around 4.0%” after a stronger-than-expected Q3, even as manufacturing PMI slipped back to a neutral 50 in October and surveys flagged slower momentum ahead.

MAS kept policy unchanged in October, noting that core inflation has eased but is likely to trough soon before gradually rising again into 2026.

Private-sector PMI data still show modest expansion at the start of Q4, suggesting domestic demand remains supportive even as external headwinds persist.

In this environment, we continue to prefer quality names with recurring earnings and healthy balance sheets over chasing short-term rallies in more speculative counters.

The index has recently pullback to test the 4,500 support level, after nearing the 4600 resistance level,

All 3 moving averages are still heading upwards, indicating that uptrend remains intact for STI. Furthermore, a new 1GT Bullish Signal appeared in Nov 25 is still playing out.

If index can break and hold above 4,600, potential upside target towards 4,700. Overall, Singapore market looks to remain bullish with continued strength and momentum.

Hot News (Click to read):

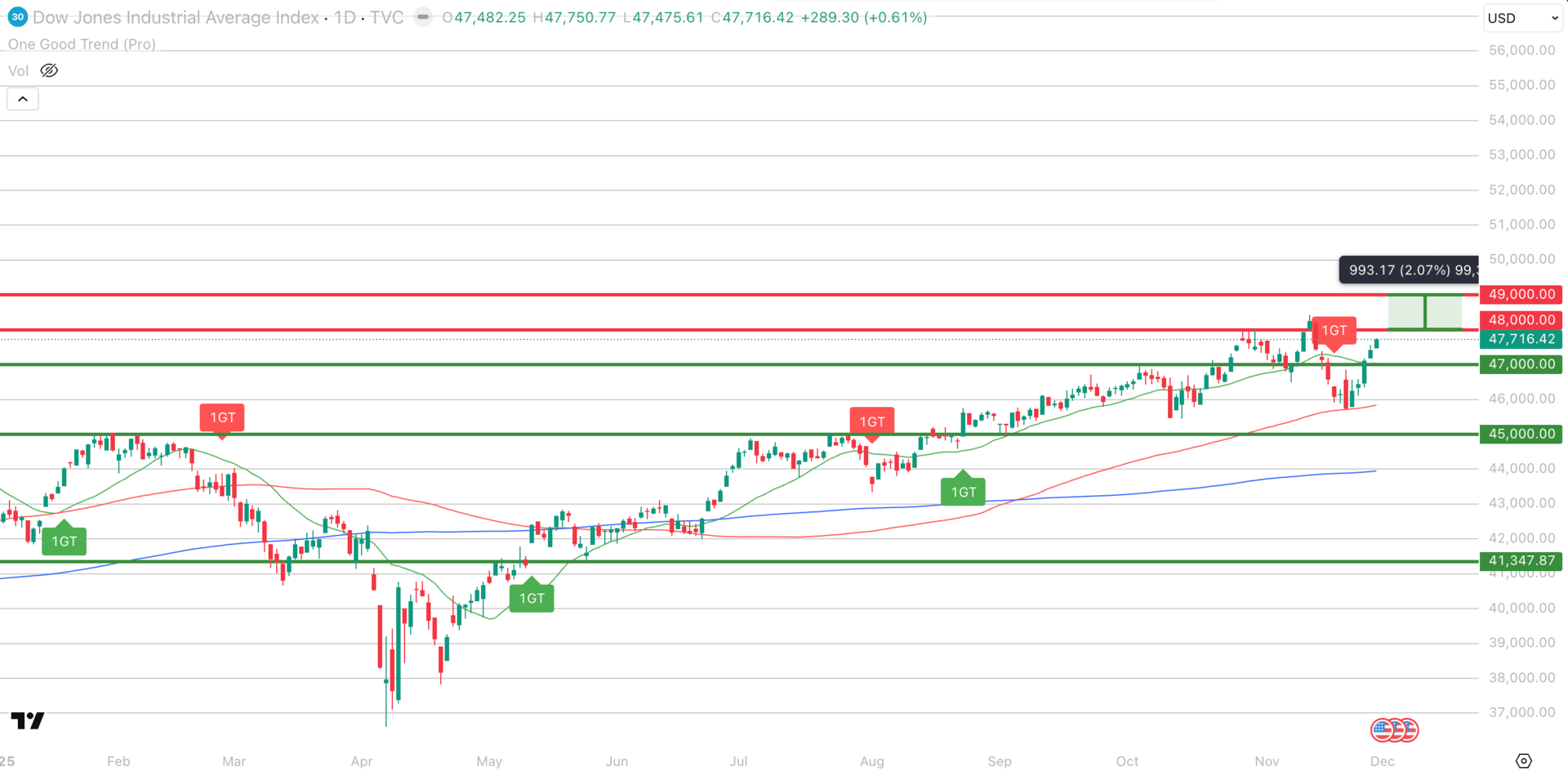

Dow Jones Industrial Average (TradingView)

Dow Jones Industrial Average (DJIA) tracks the daily price movements of 30 large, public-owned blue-chip American companies.

Selling pressure picked up as the index retreated from 48,000, and dipping below the 47,000 support, now turned resistance, weakness was present in the near term with the 20d moving average slopping down, the key support looks to be around the 45,000, potentially a level where bargain hunting could appear again.

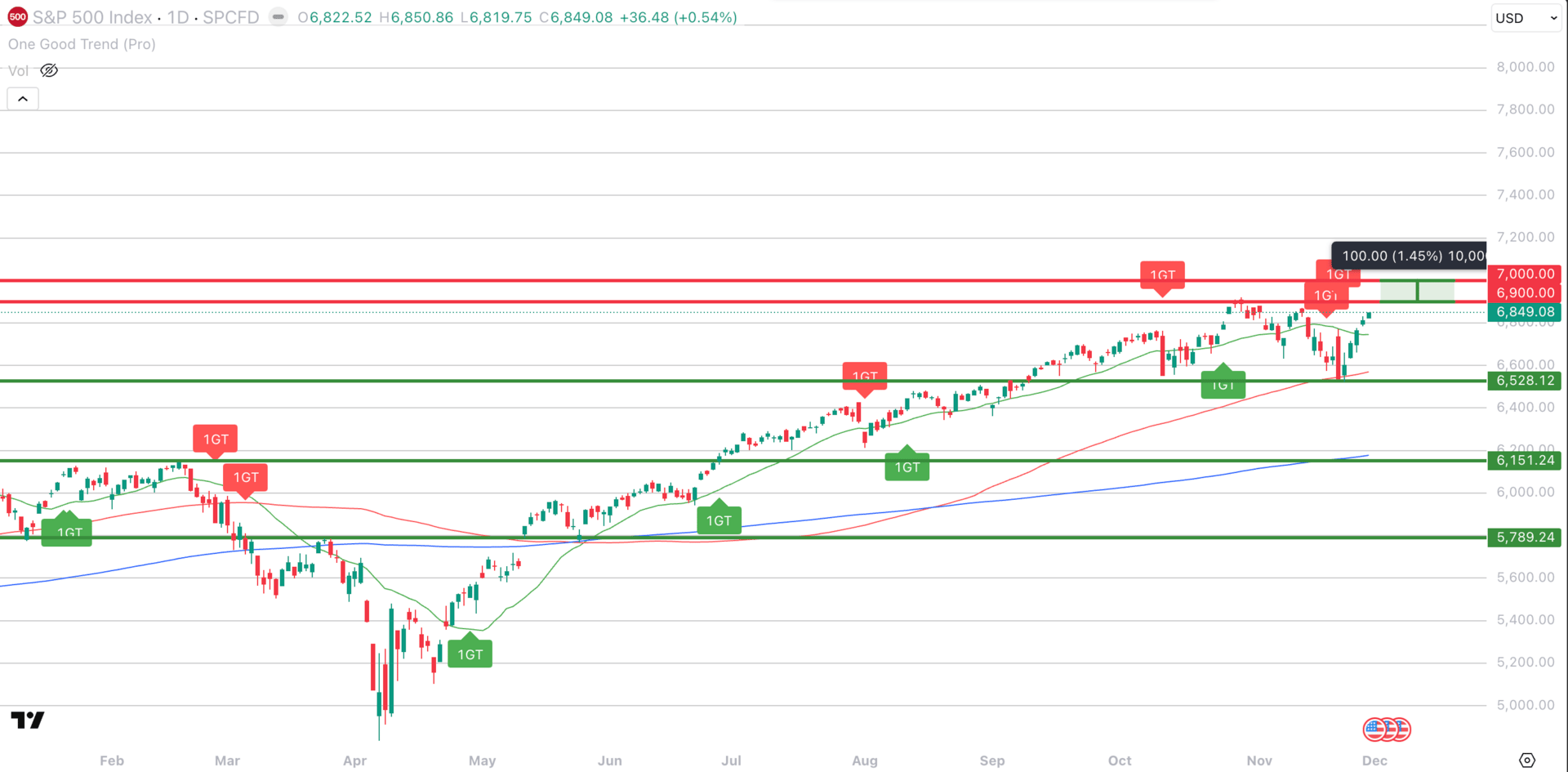

S&P 500 (TradingView)

S&P 500 Index is a market-capitalization weighted index of the 500 leading companies in the US which is widely considered as one of the best gauge of the US economy.

Pulling back from the 6,900 resistance, the index rebounded from the support around the 6,500 level once again. While the longer term uptrend looks intact, the shorter term weakness still persists, with 2 consecutive 1GT Bearish Signals in play. Note that 7,000 psychological level remains as the initial longer term target if the index rebounds.

U.S. equities had a choppy November. After flirting with record highs earlier in the month, the major indices saw a series of sharp pullbacks as investors questioned whether AI-linked names like Nvidia had run too far, too fast. On 18 November, the S&P 500 fell 0.8%, the Dow lost over 1%, and the Nasdaq dropped 1.2% as worries about an “AI bubble” and stretched valuations weighed on sentiment

Macro signals were mixed. Inflation is still running around 3% on the latest available CPI print for September, but October’s CPI and jobs reports were cancelled due to the U.S. government shutdown, creating a rare “data vacuum” for the Fed.

Hot News (Click to read):

Singapore Stocks Spotlight

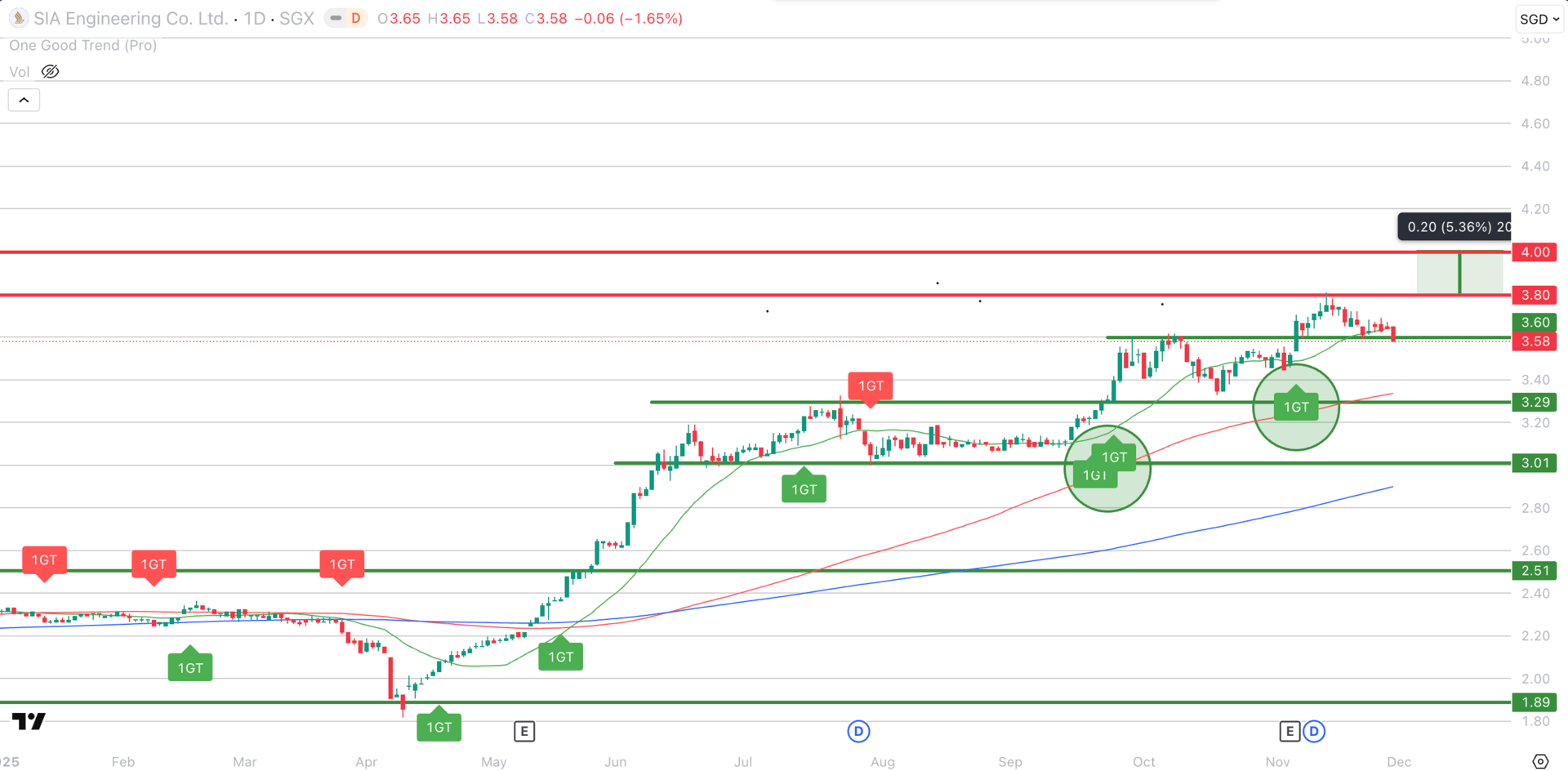

SIA Engineering (S59.SI)

Target Price: S$4.00

SIA Engineering (TradingView)

1GT Bullish Entry Signal Appeared on 06 Nov 25, No Exit Signal Yet

About SIA Engineering

SIA Engineering Company is a leading aircraft maintenance, repair and overhaul (MRO) provider in Asia, supporting Singapore Airlines, Scoot and more than 80 international carriers

Its core businesses span airframe and line maintenance at Changi and across a regional network, as well as engine and component MRO through joint ventures with global OEMs

This JV-heavy model gives SIAEC exposure to high-value engine work while keeping its capital base relatively light

Fundamental

For 1H FY2025/26 (ended 30 Sep 2025), SIAEC reported a strong set of results, with revenue up 26.5% y/y to S$729m on robust demand for MRO services and higher heavy-check activity

Net profit grew 21.1% y/y to S$83.3m, driven by a nearly threefold jump in operating profit to S$13m and a 21.7% increase in contributions from associates and JVs to S$71.3m, mainly from engine and component shops

The group declared an interim dividend of 2.5 cents per share (up 25% y/y), and still held S$575m of cash on its balance sheet as at 30 September, underscoring its healthy financial position

A new S$1.3bn, two-year comprehensive services agreement with SIA and Scoot, effective 1 April 2025, further strengthens workload visibility

Technical

Price has recently broke above the 3.60 resistance on 6 Nov with a long green bullish candlestick, turning it to become a new higher support

Uptrend remains firmly intact with all 3 moving averages aligning and heading upwards in the same direction

Note that 3 consecutive 1GT Bullish Signals are still playing out

As long as price is able to hold firmly above 3,60, next potential upside towards psychological 4.00, where some profit-taking could return

SINGTEL (Z74.SI)

Target Price: S$5.00

Singtel (TradingView)

1GT Bullish Entry Signal Appeared on 6 Nov 25, No Exit Signal Yet

About Singtel

Singtel is Singapore’s largest telecom operator and a leading regional communications group with operations across Singapore, Australia (Optus) and stakes in major mobile operators such as Bharti Airtel, Telkomsel and AIS

Its core businesses span mobile, broadband and pay TV, as well as ICT services via NCS and a fast-growing digital infrastructure arm (Nxera / Digital InfraCo), which houses regional data centres, subsea cables and 5G edge/cloud platforms

Fundamental

For 1H FY2026 (half-year ended Sep 2025), Singtel reported net profit of S$3.40 billion, boosted by one-off gains from the Airtel stake sale and the Intouch–Gulf Energy merger, while underlying profit rose 14% y/y to S$1.35 billion on stronger contributions from Optus and regional associates

Optus operating earnings jumped 27%, and associate contributions grew over 20%, underscoring the strength of its regional portfolio

Management raised full-year guidance, now expecting OpCo EBIT to grow in the high single to low double-digit range, and lifted the interim dividend to 8.2 cents (from 7.0 cents a year ago)

Singtel is also leaning into digital infrastructure: its Nxera data centre business is targeting >20% annual EBITDA growth over the next four years, supported by new builds (including a green-financed 58MW DC in Tuas) and potential M&A such as the proposed STT GDC transaction

Overall, Singtel offers a mix of improving earnings momentum, growing infra optionality and a progressive dividend profile heading into FY2026

Technical

Singtel was trading sideways between the range of 4.00 - 4.40 since Aug to Nov

Price eventually managed to break out above the 4.40 resistance with a new 1GT Bullish Signal, turning to become a new higher support

There appears to be some temporary selling pressure around the 4.80 level for the time being. However, initial target could be raised to psychological 5.00 level where it is not surprising for profit-taking to return

Uptrend remains firm with all 3 moving averages heading up, as long as price is able to continue holding above the trailing support

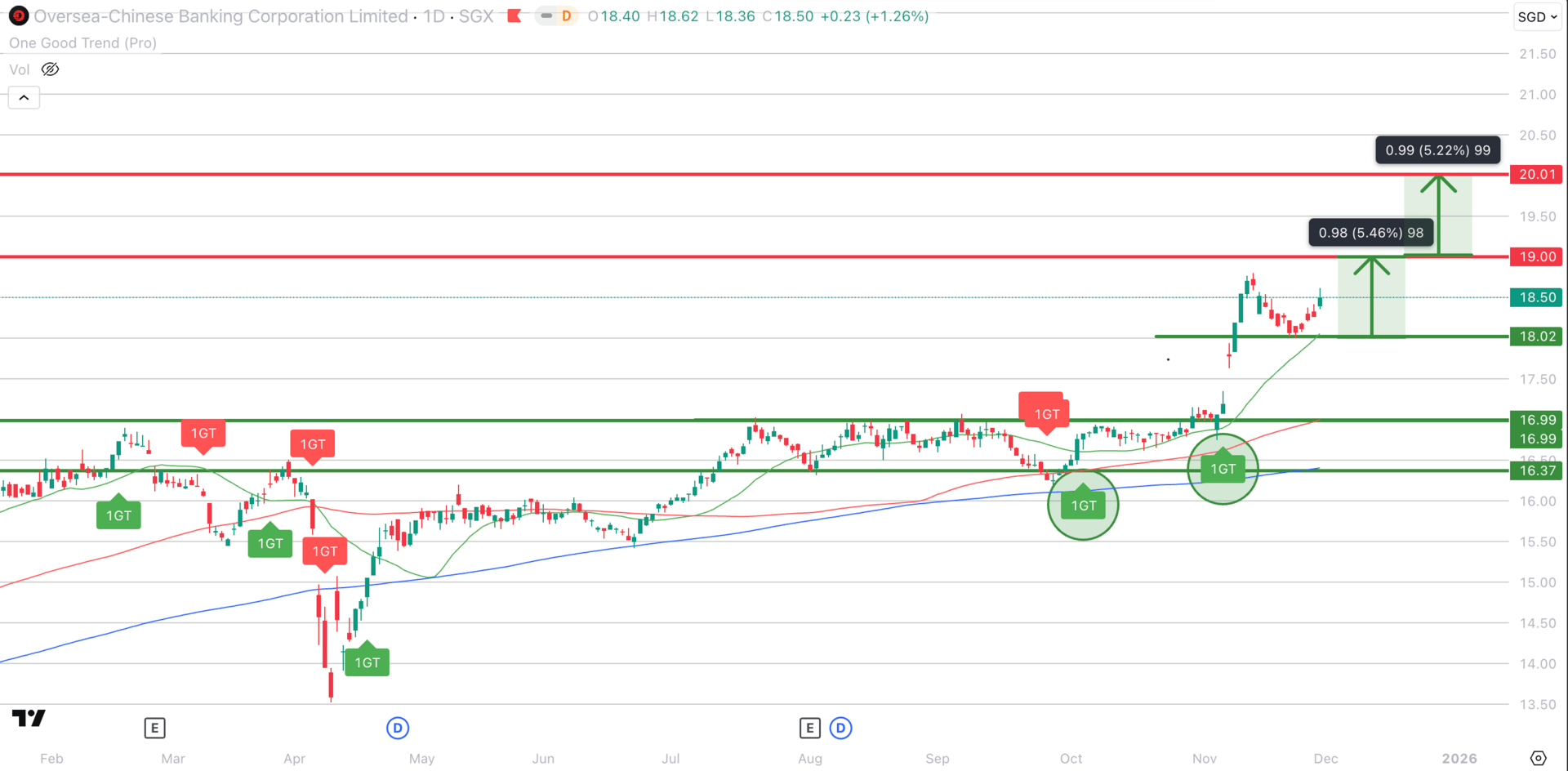

OCBC BANK (O39.SI)

Target Price: S$19.00

OCBC Bank (TradingView)

1GT Bullish Entry Signal Appeared on 6 Nov 25, No Exit Signal Yet

About OCBC Bank

OCBC is Singapore’s second-largest bank by assets, offering a full suite of banking, wealth management and insurance services across Asia. Its main business segments are Global Consumer/Private Banking, Global Wholesale Banking, Global Markets, and Insurance (via its majority stake in Great Eastern), plus an “Others” segment that includes investment and property activities

Fundamental

OCBC delivered a steady set of 3Q25 results, with net profit at S$1.98 billion, flat YoY but about 9% higher QoQ and ahead of market estimates, supported by stronger non-interest income and lower allowance

Revenue rose 7% QoQ, as fee and trading income pushed non-interest income to a quarterly high, while wealth management income hit a record and banking wealth AUM climbed 18% y/y

Net interest income remained under pressure, with NIM easing to around 1.84%, and management now guides for full-year 2025 NII to decline by a mid-single-digit percentage, with NIM expected in the 1.90–1.95% range, below the earlier 2% target

For 1H25, net profit of S$3.70 billion was just 6% below last year’s record, as softer NII was largely offset by an 8% rise in non-interest income and 19% growth in fee income, led by a 25% jump in wealth management fees

Technical

Prices broke out of the 17.00 key resistance, finding a new higher support around the 18.00 psychological level.

Note that all 3 moving averages have started to slope up since the breakout

Immediate resistance around the 19.00 level where profit taking can be expected

A break above the new resistance level could mark a new leg in this uptrend with next target toward the 20.00 psychological level

While trailing support is flattening out after the upmove, OCBC could be heading toward a higher consolidation range where a stop order under the trailing support could be beneficial to protect profits as well as providing a guide for new entries

United States Stocks Spotlight

APPLE INC (AAPL.NQ)

Target Price: US$300.00

Apple Inc (TradingView)

1GT Bullish Entry Signal Appeared on 7 Aug 25, No Exit Signal Yet

About Apple Inc

Apple is a global technology company that designs and sells consumer hardware like the iPhone, Mac, iPad, Apple Watch and AirPods, alongside a fast-growing portfolio of services including the App Store, iCloud, Apple Music, Apple TV+, Apple Pay and AppleCare

Its ecosystem is built around tightly integrated hardware, software (iOS, macOS, visionOS) and services, with over 2 billion active devices worldwide forming a sticky, recurring-revenue base

Fundamental

Apple delivered a record Q4 FY2025 (September quarter) with revenue of US$102.5 billion (+8% y/y) and net profit of about US$27.5 billion, beating market expectations

Growth was broad-based: iPhone revenue rose 6% to US$49 billion, helped by the iPhone 17 launch and a large base of users who have not upgraded in several years, while Mac sales grew 13% to US$8.7 billion

The standout remains Services, which generated about US$28.8 billion (+15% y/y) and now accounts for roughly a quarter of total revenue but a much larger share of profit, due to gross margins in the 70–75% range

While competition in China and ongoing regulatory scrutiny around its Services/App Store business remain key risks, Apple’s massive installed base, high-margin services engine and healthy balance sheet keep it positioned as a long-term cash-generating compounder

Technical

Prices found a new higher support after prices breached the previous high of 260.00, signaling that buyers are still keen to accumulate on a break out

With the immediate resistance around the 280.00 level, sellers seem to have emerged over the last few days as prices test this new level

If prices are able to break and hold above this level, forming a new higher support, the target can be revised higher toward the 300.00 psychological level

Recent News (Click to Read)

ALPHABET INC (GOOGL.NY)

Target Price: US$340.00

Alphabet Inc (TradingView)

1GT Bullish Signal Appeared on 25 Aug 25, No Exit Signals Yet

About Alphabet Inc

Alphabet is the parent company of Google, operating a portfolio of businesses centred on search, digital advertising, cloud computing, and AI

Its core Google Services segment includes Search, YouTube, Android, Chrome, hardware and subscriptions, while Google Cloud provides infrastructure and AI platforms to enterprises globally

Fundamental

Alphabet delivered a standout Q3 2025, with revenue up 16% y/y to US$102.3–102.35 billion, its first-ever quarter above US$100 billion and ahead of consensus.

Net income jumped ~33–35% y/y to about US$35 billion, with EPS at US$2.87, reflecting strong operating leverage.

Growth was broad-based: Google Services revenue rose 14% to US$87.1 billion, Search & other grew 15% to ~US$56.6 billion, and YouTube ads climbed 15% to just over US$10 billion.

Google Cloud remained a key driver, with revenue up 34% y/y to ~US$15.2 billion and margins improving to ~24%, as AI workloads and backlog (US$155 billion) accelerated.

Management again raised 2025 capex guidance to US$91–93 billion to fund data centres and AI infrastructure, underscoring its aggressive push to lead in AI

Technical

Renewed strength can be observed late Nov 25, as prices broke above the 300.00 resistance heading higher to test the 320.00 resistance shortly

All 3 moving averages continue to point up with the recent momentum

Buyers could be looking to accumulate on the dips to defend the 300.00 psychological support

Potential target toward the 340.00 level if 320.00 gives way.

2 consecutive 1GT Bullish Signals still playing out with no exits yet

Recent News (Click to Read)

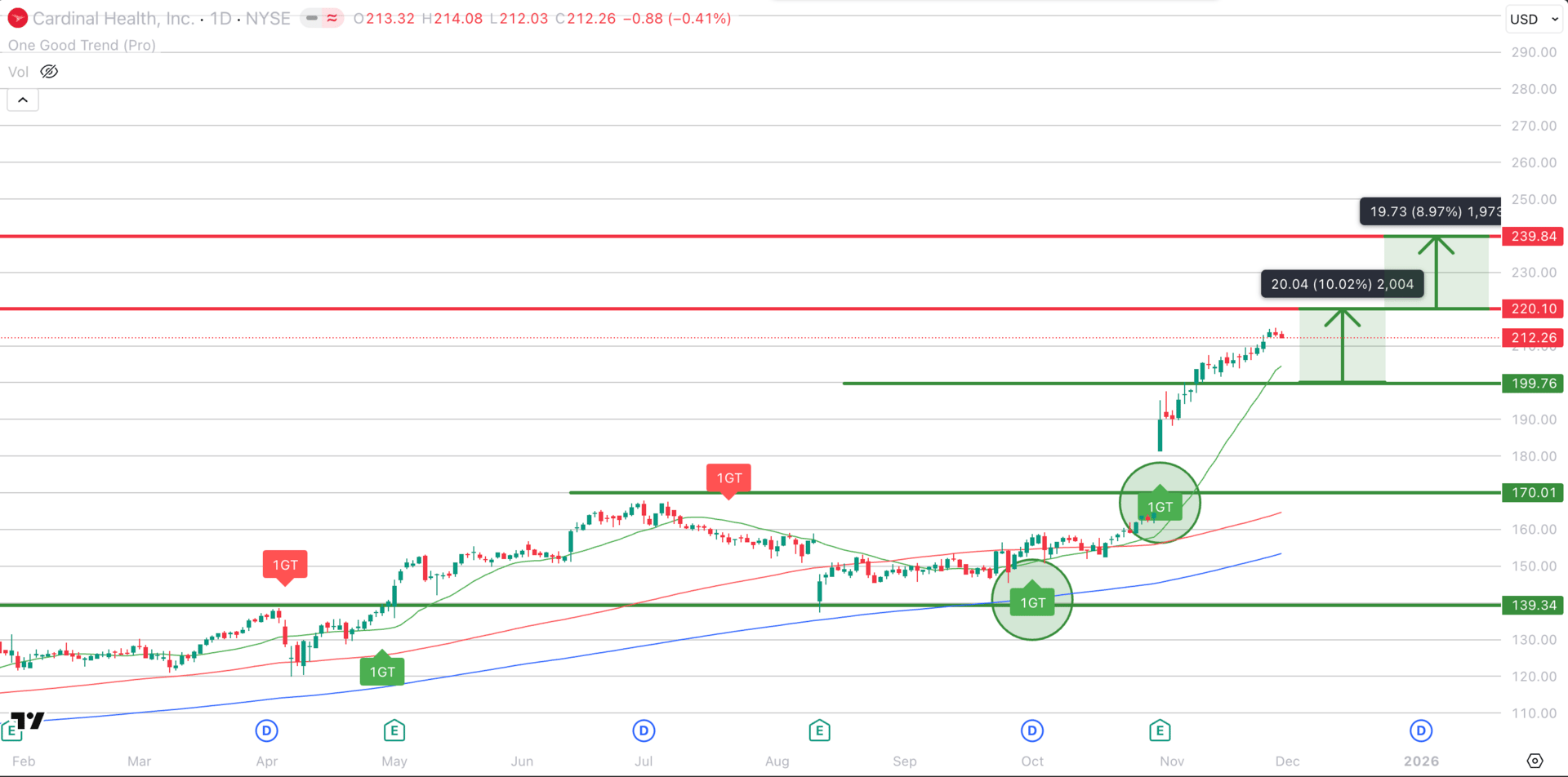

CARDINAL HEALTH INC (CAH.NY)

Target Price: US$240.00

Cardinal Health inc (TradingView)

1GT Bullish Entry Signal Appeared on 30 Oct 25, No Exit Signal Yet

About Cardinal Health

Cardinal Health is a U.S. healthcare services and products company, and one of the largest pharmaceutical distributors in the world. Headquartered in Dublin, Ohio, it serves more than 100,000 locations including hospitals, pharmacies, and physician clinics

Fundamental

Fiscal 2025 was another strong year for Cardinal Health. Revenues came in at US$222.6bn (-2% y/y due to the expiry of a major OptumRx contract), but non-GAAP operating earnings rose 15% to US$2.8bn, driven by profit growth in Pharmaceutical and Specialty Solutions and the “Other” segment

Non-GAAP EPS increased 9% to US$8.24, and management subsequently raised FY2026 EPS guidance to US$9.30–9.50, signalling confidence in continued margin expansion

The core Pharmaceutical segment continues to benefit from high-value specialty medicines and branded drug demand, while the medical products business has returned to positive profit and cash flow after restructuring

Cardinal is also investing for growth, including a US$1.9bn acquisition of Solaris Health to bolster its Specialty Alliance MSO platform and a new automated specialty-drug distribution centre in Indianapolis

Technical

Prices has formed a new multi-year high after firmly breaking above the 170.00 resistance during end Oct, and it swiftly broke above the 200.00 psychological level as well

For the past month in Nov, prices have progressed higher toward the immediate 220.00 resistance

All 3 moving averages continue to show strength toward the next target of 240.00

Trailing support currently also reaffirms the uptrend, and to note that one could place a potential stop below this level to protect profits

Recent News (Click to Read)

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Conditions