- Joey Choy Top Stocks

- Posts

- GLD: Gold’s Time to Shine Again?

GLD: Gold’s Time to Shine Again?

A look at how gold is making a comeback as investors brace for economic uncertainty.

GLD: The Go-To ETF for Gold Exposure

When investors talk about “owning gold,” most don’t mean stacking physical bars in a safe. (Well, you could but you would probably need a safe for that…)

Instead, they look to GLD, the SPDR Gold Shares ETF. It’s one of the largest and most liquid gold-backed ETFs, giving investors a simple way to track the price of gold without dealing with storage or security.

GLD is directly tied to physical bullion, making it a popular choice for those who want exposure to gold prices during uncertain economic times. It’s also widely used by institutional investors, so its moves can reflect broader market sentiment toward the metal.

Gold’s Resurgence Amid Global Uncertainty

In recent weeks, gold has been gaining momentum again. Several factors are coming together to create a bullish backdrop:

Geopolitical Tensions: The Venezuela-Guyana border conflict and broader instability in regions like the Middle East are driving safe-haven demand. Investors tend to rush into gold during geopolitical shocks, and we're seeing that play out once more .

Currency Volatility: With central banks around the world adjusting interest rates and managing inflation, currencies like the U.S. dollar have seen volatility. Gold tends to perform well when fiat currencies weaken.

Global Financial Shifts: A deeper shift in global finance is taking shape. Many nations, especially emerging economies, are increasing their gold reserves as part of a long-term strategy to reduce dependency on the U.S. dollar and Western banking systems .

Central Bank Buying: In 2023 and into 2024, central banks have been quietly buying gold at one of the fastest paces in decades. This is a strong foundational support for gold prices.

Gold vs. Equities: The Defensive Rotation in Play

We’re potentially entering a market environment where defensiveness matters again. With fears of recession still lingering and equity markets running hot, some investors are rebalancing into assets like gold to hedge potential downside.

GLD gives that exposure with less direct correlation to stocks, especially tech-heavy indices like the NASDAQ. For cautious investors, adding a bit of GLD can act as a volatility buffer when stocks wobble.

Technical Setup: Watching for a Breakout or Consolidation?

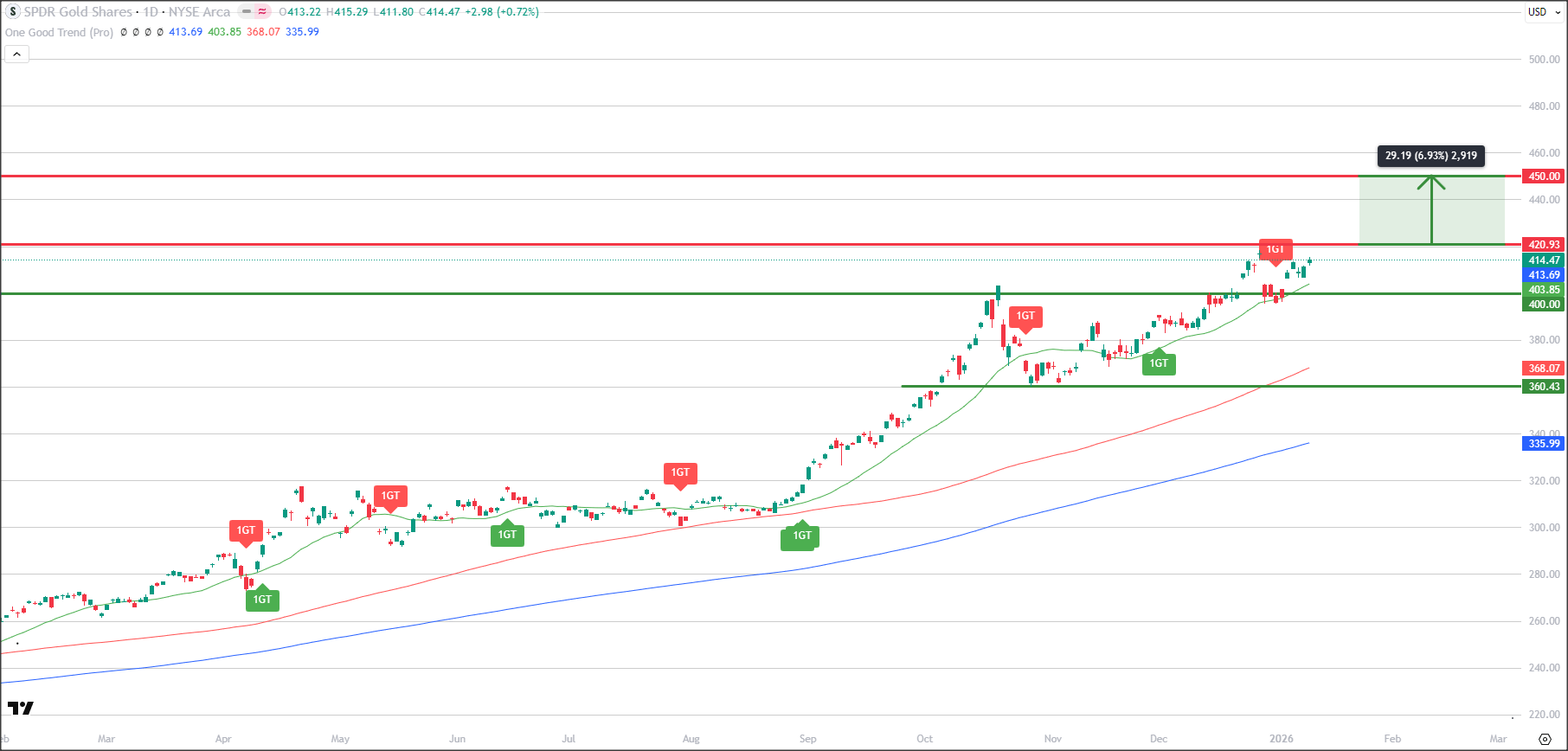

SPDR Gold Shares (TradingView)

GLD recently tested near-term psychological resistance around 420 and is once again approaching the multi-year high of 418.45

Would not be surprised if profit-taking return near the resistance

Immediate support appears to be around 400, where bargain hunting returned previously

Uptrend remains firmly intact with both longer-term and shorter-term moving averages heading upwards

If price can break and hold firmly above 420, targets could be revised higher toward 440 - 450

The big question: will gold break out to new highs, or pause and consolidate? Either way, the current trend is still looking pretty bullish…

Final Take: Why GLD Deserves a Spot on Your Radar?

Gold’s narrative is shifting. It’s no longer just a “crisis hedge”…

It’s becoming a more strategic asset in a rapidly changing global financial system. Whether it’s central banks loading up, investors hedging against equities, or tensions flaring across the globe, gold is back in the spotlight.

If you’re looking for a way to add some stability to your portfolio, or simply want to benefit from gold’s upward momentum, perhaps GLD could be worth watching and adding it into your watchlist.

Hope you have found the above stocks useful 😃

If you have yet to be a part of Joey’s VIP clients in Phillip Securities receiving his Exclusive WhatsApp Broadcast daily, you can check it out here!

Joey and team post Top SG Stock Ideas, Market Updates, Research Reports and training videos on a daily basis at NO additional cost.

Look forward to see you on the inside!

- Joey, Bervyn & Zee

Sources:

1. Gold Surges to One-Week High as Venezuela Crisis Reignites Safe-Haven Demand. Available at: https://europeanbusinessmagazine.com/business/gold-surges-to-one-week-high-as-venezuela-crisis-reignites-safe-haven-demand/

2. Gold, Silver And Metals Reveal Hidden Shifts In Global Finance. Available at: https://www.businessworld.in/article/gold-silver-and-metals-reveal-hidden-shifts-in-global-finance-586045

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Condition