- Joey Choy Top Stocks

- Posts

- Hong Kong Markets Are Steadying: 3 Stocks Showing Constructive Momentum

Hong Kong Markets Are Steadying: 3 Stocks Showing Constructive Momentum

Bullish structures form as financials and recovery plays regain traction.

Executive Summary

Hong Kong’s market is beginning to show signs of stabilisation after an extended period of choppy and directionless trading. With volatility easing and sentiment slowly improving, price action across selected blue chips is starting to look more constructive, particularly in sectors tied to financial strength and consumption recovery.

In this month’s SDR update, three Hong Kong heavyweights stand out: HSBC Holdings, Ping An Insurance, and Trip.com Group. Each stock is holding above key moving averages, suggesting that momentum may be rebuilding beneath the surface.

All three stocks are available on the SGX as SDRs, providing Singapore-based investors with a straightforward way to participate in Hong Kong’s next potential move in SGD.

1) Trip.com Group (9961.HK); TRIP.COM HK SDR 50TO1 (HTGD)

Trip.com (9961.HK) is back on the radar as one of the more resilient China consumer-tech names, especially with travel demand staying firm and the stock holding up well despite recent market volatility. After a sharp pullback from its prior highs, the chart is now starting to stabilize and the technical picture is quietly turning constructive again.

Most notably, price has managed to hold above the key S$1.80 (HK$530) support zone, and that level is starting to look like a meaningful level for bulls.

The longer-term trend is still intact too with the stock remaining above the 200-day moving average, alongside the 100-day moving average is pointing up, suggesting the broader uptrend hasn’t been broken, with the 20-day moving average rebounding from the 100-day moving average.

Momentum is also beginning to rebuild. You can see prices gradually pushing higher from the consolidation range, and if buyers can sustain this move, the next upside levels to watch are S$1.97 (HK$580) first, followed by S$2.10 (HK$620), both areas where the stock previously faced heavy selling pressure.

A clean breakout above S$1.97 (HK$580) would be the key confirmation that the next bullish leg is underway.

💡 So how does one take a position in Trip.com Group from the HK SDR traded on the SGX?

To take a position via the Trip.com HK SDR 50to1 (Ticker: HTGD), which is listed on the SGX, note that it trades with a 50 SDR to 1 share ratio.

Based on a 0.17 HKD-to-SGD exchange rate, the SDR is currently priced around S$1.88 - S$1.90.

Conservative traders may prefer to wait for a stronger breakout above S$1.97 (HK$580) to confirm momentum and higher support re-captured

Aggressive traders might look to accumulate closer to the S$1.80 (HK$530) support zone, keeping risk tight in case the consolidation breaks down.

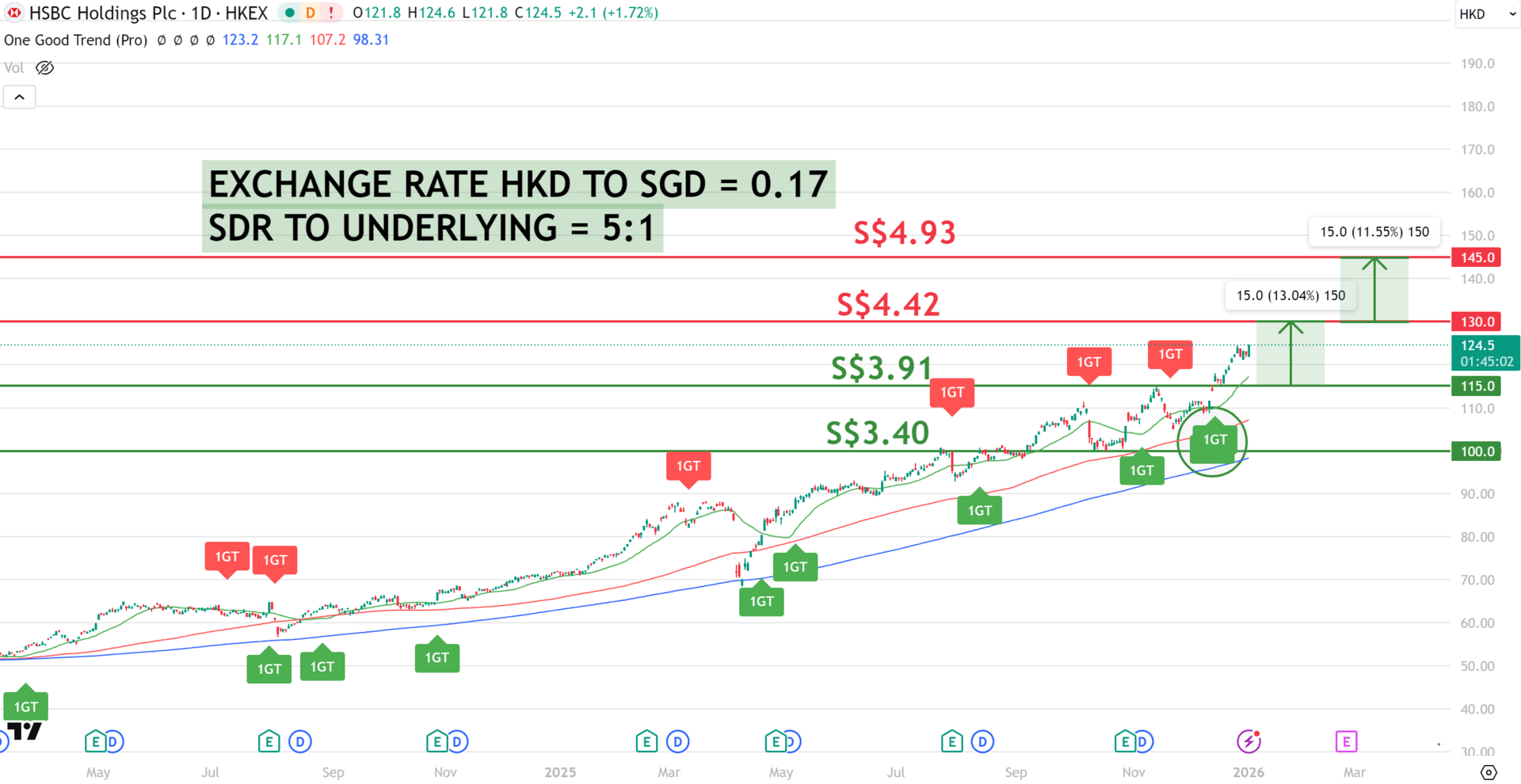

2) HSBC Holdings PLC (5.HK); HSBC HK SDR 5TO1 (HSHD)

HSBC Holdings PLC (5.HK) is one of the world’s largest banking and financial services groups, with a strong presence across Asia, Europe, and the Americas. In Hong Kong, it remains a core financial heavyweight and a key beneficiary of higher interest rates and cross-border capital flows.

HSBC has previously pulled back from the S$3.91 (HK$115) region in November and retraced toward the S$3.40 (HK$100) level.

Prices were able to break above the S$3.91 (HK$115) resistance level in December, which has also triggered a 1GT Bullish signal.

The stock continues to trade comfortably above both the 100-day and 200-day moving averages, which are still sloping upward, reinforcing a healthy medium-term trend.

The 20-day moving average has also turned higher after the recent pullback, indicating stronger short-term strength as well.

Price is now moving toward the S$4.42 (HK$130) resistance level. A decisive break above this level could open the path toward more upside towards the next resistance of $4.93 (HK$145)

💡 So how does one take a position in HSBC from the HK SDR traded on the SGX?

You can take a position via the HSBC HK SDR 5to1 (Ticker: HSHD), which trades on the SGX with a 5 SDR to 1 underlying share ratio. Using the 0.17 HKD-to-SGD exchange rate, the SDR is currently priced around S$3.90 – S$4.10, reflecting the underlying chart structure.

A conservative approach would be to accumulate near S$3.91 (HK$115) on pullbacks, where strong support and trend structure align.

A more aggressive entry could be taken on a confirmed breakout above S$4.42 (HK$130), with S$4.93 (HK$145) as the next upside target and a stop below the S$4.42 (HK$130) level if price fails to hold.

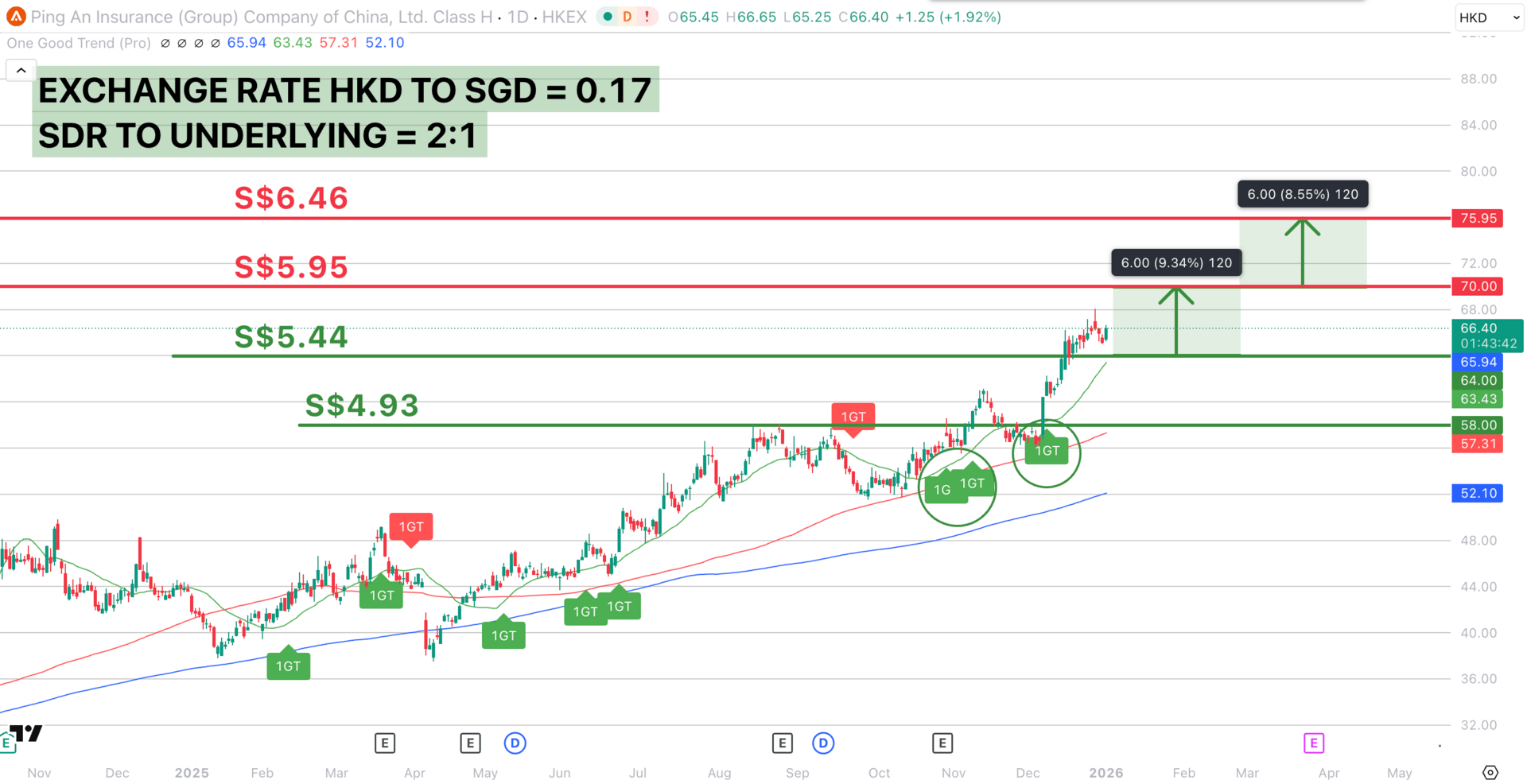

3) Ping An Insurance (2318.HK); PING AN INS HK SDR 2TO1 (HPAD)

Ping An Insurance (2318.HK) is one of China’s largest integrated financial groups, with core businesses spanning life and health insurance, property insurance, banking, asset management, and digital financial services.

From a trend perspective, the stock remains firmly above the 100-day (red) and 200-day (blue) moving averages, both of which are pointing upward. A classic bullish alignment and tells us the longer-term trend is intact.

Short-term momentum is also supportive as the 20-day moving average (green) is rising strongly, and the most recent bullish 1GT (Pro) signal came at a clean rebound point, which helped set up this latest breakout.

The key level to watch now is the S$5.44 zone (HK$64), which has acted as the recent launchpad. As long as price holds above that area, the uptrend remains healthy. On the upside, the next resistance/target levels sit at S$5.95 (HK$70) first, followed by S$6.46 (HK$76) — these are the next “profit-taking zones” where sellers may reappear after the strong run.

💡 So how does one take a position in Ping An Insurance from the HK SDR traded on the SGX?

To take a position via the Ping An Ins HK SDR 2to1 (Ticker: HPAD), which is listed on the SGX, note that it trades with a 2 SDR to 1 share ratio.

Based on a 0.17 HKD-to-SGD exchange rate, the SDR is currently priced around S$5.50 - S$5.54.

Conservative traders may prefer to wait for a pullback and hold above S$5.44 (HK$64) to reduce chase risk.

Aggressive traders might stay with the trend while it remains above the rising 20-day moving average, using the recent breakout structure as their guide, taking a position if prices break above the S$5.95 (HK$70) resistance with a stop limit under this level.

About the Author - Joey Choy

Joey is Singapore’s renowned mentor on how to make an income by trading the stock market, an author and one of the most-watched, quoted and followed stock trading trainers in Singapore. Over the years, he has conducted numerous full house seminars, enriching thousands to trade more profitably.

Joey’s come back story from a S$740k debt has been featured in the Business Times and inspired thousands in Singapore. In less than 3 years, he is highly regarded as one of the Top Tier Remisiers (Stock Brokers) and Traders, bagging numerous yearly awards like Top Trading Representative and Top CFD Achiever every year from 2014 to 2023 in Phillip Securities.

More about Joey here

Hope you have found the above content useful 😃

If you are keen to find out more on how to be a VIP Client of mine to receive daily market updates and exclusive actionable stock ideas, you can check it out here!

Look forward to see you on the inside!

- Joey

Disclaimer and Warning

This publication is provided by Trading Impossible Pte Ltd for general information and educational purposes only. Trading Impossible Pte Ltd is NOT licensed or regulated for the provision of investment or financial advice, and we do not seek to do so.

This content has been produced by Trading Impossible Pte Ltd. Singapore Exchange Limited (“SGX”) and/or its affiliates (collectively with SGX, the “SGX Group Companies”) have not had any input into this publication and/or the content, and SGX shall not be responsible or liable for the same. This document/material is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document/material has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Use of and/or reliance on this document/material is entirely at the reader’s own risk. Trading Impossible Pte Ltd shall not be liable for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Any forecast, prediction or projection in this document/material is not necessarily indicative of the future or likely performance of the product. Examples (if any) provided are for illustrative purposes only. This document/material is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject the SGX Group Companies to any registration or licensing requirement. While each of the SGX Group Companies have taken reasonable care to ensure the accuracy and completeness of the information provided, each of the SGX Group Companies disclaims any and all guarantees, representations and warranties, expressed or implied, in relation to this document/material and shall not be responsible or liable (whether under contract, tort (including negligence) or otherwise) for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind, including without limitation loss of profit, loss of reputation and loss of opportunity) suffered or incurred by any person due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information, or arising from and/or in connection with this document/material. The information in this document/material may have been obtained via third party sources and which have not been independently verified by any SGX Group Company. No SGX Group Company endorses or shall be liable for the content of information provided by third parties (if any). The SGX Group Companies may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Each of SGX, Singapore Exchange Securities Trading Limited and Singapore Exchange Bond Trading Pte. Ltd. is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document/material is subject to change without notice. This document/material shall not be reproduced, republished, uploaded, linked, posted, transmitted, adapted, copied, translated, modified, edited or otherwise displayed or distributed in any manner without SGX’s prior written consent. Please note that the general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document/material.