- Joey Choy Top Stocks

- Posts

- January 2026 Newsletter

January 2026 Newsletter

Market Updates and Top Stock Picks from Singapore & US market

Hello everyone,

.Happy New Year! I hope you had a great break and are recharged for 2026. A big thank you for your continued support and encouragement , it means the world to me and my team.

As we step into the new year, markets remain cautiously optimistic. While interest rate cuts are still on the table for this year, uncertainties around global growth and policy shifts will keep things interesting.

That said, a new year always brings new opportunities and I’m excited to navigate them together with you.

Let’s start strong and make 2026 a winning year. one good trend at a time.

Your No.1 Fan,

Joey Choy

Market Overview

Singapore

Straits Times Index (TradingView)

Straits Times Index (STI) is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

Straits Times Index (STI) is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

2025 turned out to be a breakout year for Singapore equities. After several sleepy years, the Straits Times Index (STI) finally woke up rising about 21–23% for the year and hitting a record high towards the end of the year crossing the 4,600 level.

On the macro side, the backdrop stayed surprisingly supportive. The Ministry of Trade and Industry upgraded 2025 GDP growth to “around 4.0%” after stronger-than-expected Q3 numbers, while pencilling in a more normal 1–3% growth range for 2026.

MAS kept monetary policy unchanged at its October review, maintaining a cautiously neutral stance as core inflation hovered around 1.2% and is forecast to average just 0.5–1.5% in 2025–26, low by historical standards but expected to edge up gradually.

With new support being found at the 4,600, the index continues to see buying interest as renewed strength picked up after the index briefly dipped toward the 4,450 support.

Moving averages continue to demonstrate strength as the 20 days moving average continues to slope up and stay above the 100 day and 200 day moving average

With the immediate resistance drawn toward the 4,750 resistance first, potentially could see the index resume its consolidation pattern before attempting to break higher

Hot News (Click to read):

Dow Jones Industrial Average (TradingView)

Dow Jones Industrial Average (DJIA) tracks the daily price movements of 30 large, public-owned blue-chip American companies.

Holding above the 48,000 support, selling pressure continues to show up as prices approach the 49,000 resistance level, with the 20d, 100d, and 200d moving averages still sloping up, the immediate target above 49,000 would remain around the 50,000 level

S&P 500 (TradingView)

S&P 500 Index is a market-capitalization weighted index of the 500 leading companies in the US which is widely considered as one of the best gauge of the US economy.

Seeing buyers return as the index attempts to hold above the 6900 level where the immediate target continues to be around the 7,000 resistance level, alongside confirmation that the longer term uptrend remains intact where the 100d and 200d moving averages point up.

2025 closed as the third straight strong year for U.S. equities, the rally has been heavily powered by AI-linked mega caps especially Nvidia, which made headlines by becoming the first US$5 trillion company in October, underscoring just how concentrated market leadership has become.

Heading into January 2026, the base case is not another straight-line melt-up but a more range-bound and stock-selective market: the AI and rate-cut narrative should continue to support sentiment, but any disappointment on earnings, data or policy could trigger quick reversals. In this environment, we’ll stay focused on companies with real earnings, strong balance sheets and clearer 2026 cash-flow visibility, rather than simply chasing whatever is hottest in the AI trade.

Hot News (Click to read):

Singapore Stocks Spotlight

DBS BANK (D05.SI)

Target Price: S$60.00

DBS Bank (TradingView)

1GT Bullish Entry Signal Appeared on 12 Dec 25, No Exit Signal Yet

About DBS Bank

DBS Bank, Singapore’s largest bank, was founded in 1968 as the Development Bank of Singapore and has grown into a leading financial institution in Asia, operating in 18 markets.

Focusing on consumer banking, institutional banking, and treasury services, with a strong presence in Greater China, Southeast Asia, and South Asia.

Recognized as one of the world’s safest and best banks

Fundamental

With a strong close to FY25, reporting S$3 billion in 3Q25 earnings and maintaining its generous dividend trajectory. The bank continues to reward shareholders with a fixed dividend policy, 75 cents per quarter, comprising 60 cents in ordinary dividends and 15 cents in capital return.

The dividend payout is expected to hold until FY27, giving long-term investors a total return of around 5.5% dividend yield, backed by consistent earnings visibility

While net interest income dipped slightly year-on-year due to lower NIMs, fee income surged 22% on the back of wealth management (+31% YoY), loan-related fees (+25%), and investment banking (+65%) growth

Looking ahead, management expects FY26 earnings to soften slightly as interest rates ease, but non-interest income, particularly from trading and wealth—will remain a key driver.

Technical

With the new support around the 55.00 psychological level holding, buying interest seems to have been renewed

20d moving average currently pointing up, intersecting with the 55.00 support, while 100d and 200d moving average continues to slope upwards signaling continued longer term strength as well

With the immediate resistance drawn toward the 57.00 first, if any bullish price actions show up above this resistance, the next target would be 60.00

Multiple 1GT Bullish signals have appeared since November, while not exit signals have appeared, the trailing support is also currently close to the 55.00 level, placing a stop limit below this level could potentially protect profits and decrease downside risk

GLD US$ (O87.SI)

Target Price: US$420.00

GLD US$ (TradingView)

1GT Bullish Entry Signal Appeared on the 12 Dec 25, no exit signal yet

About GLD US$

ETF managed and marketed by State Street Global Advisors

Designed to initially track the price of a tenth of a troy ounce of gold

Fundamental

Gold is benefiting from a broader rotation into real assets, with precious metals at the forefront.

Unlike equities, gold doesn’t rely on earnings growth or valuations, making it a defensive play amid stretched tech multiples and potential volatility ahead.

Now, with rate cuts expected, inflation still hovering above target, and the US dollar in decline, gold is well-positioned to continue leading risk assets in 2026

Central bank buying remains robust, while growing concerns over sovereign debt levels and fiscal deficits are driving a renewed flight to safety.

Technical

After briefly approaching the 420.00 resistance, sellers indeed came in for profit taking, and prices had retraced towards the 400.00 support

Both shorter term and longer term moving averages still slopping upwards

Buyers should be monitoring the 400.00 psychological level closely awaiting for renewed strength for GLD

If the 400.00 level gives way, and selling pressure picks up once again, prices could once again head toward the 360.00 support.

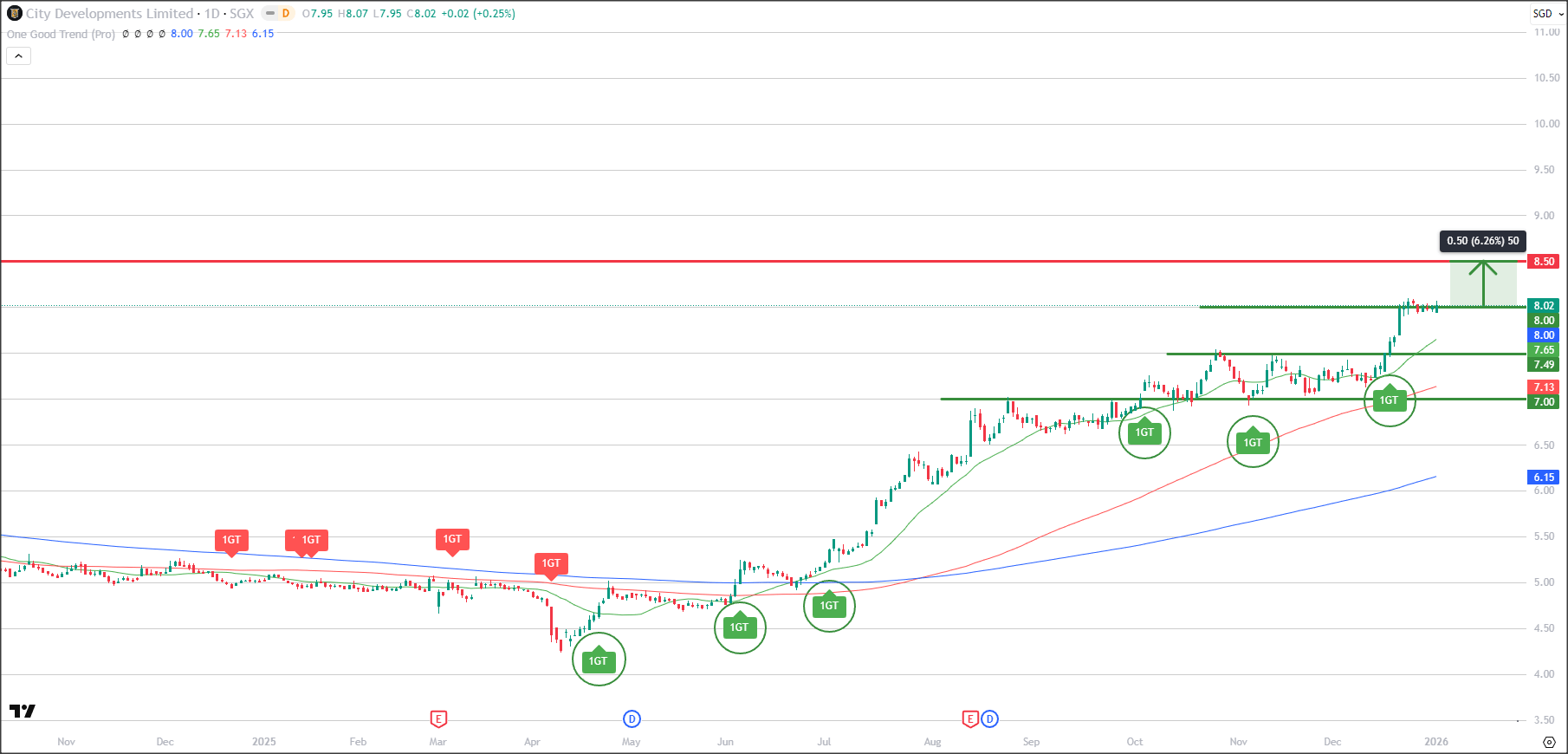

CITY DEVELOPMENT (C09.SI)

Target Price: S$8.50

City Development (TradingView)

1GT Bullish Entry Signal Appeared on 17 Dec 25, No Exit Signal Yet

About City Development

City Developments Limited (CDL) is a leading Singapore-based real estate and hospitality conglomerate. As one of the pioneers in Singapore's property sector, CDL is involved in real estate development and investment, hotel ownership and management, and facility management

CDL is also active in capital recycling strategies, divesting older or non-core assets and redeveloping legacy properties to enhance capital efficiency and unlock value.

Fundamental

Despite booking a loss in FY25, CDL is forecast to swing back into profitability in FY26, with net profit projected at S$447 million and revenue rising to S$4.27 billion, up 19% from FY25

At just 0.6x P/B and 13.8x forward P/E, valuations remain attractive as sentiment improves City Developments

The group is refocusing on its bread-and-butter, residential development and hospitality.

Its Singapore pipeline remains largely pre-sold, providing strong earnings visibility, while the hospitality arm is scaling aggressively with a target to manage up to 500 hotels globally, using lighter, franchise-based models to drive returns.

With its strategic reset now underway, CDL is well-placed to deliver improved shareholder returns in 2026.

Technical

Higher supports continuously being found, after the reversal firmed up late Jul with the 100d moving average crossing over the 200d moving average

After consolidating between the 7.00 to 7.50 range for 2 months, prices breached the 7.50 resistance to form a new support and quickly tested the 8.00 resistance

New higher target around 8.50 could be expected if prices continue to find higher support after consolidating

Latest 1GT bullish signal appeared as prices broke above the 7.50 resistance.

United States Stocks Spotlight

TAIWAN SEMICONDUCTOR MANUFACTURING CO (TSM.NY)

Target Price: US$340.00

Taiwan Semiconductor Manufacturing Co (TradingView)

1GT Bullish Entry Signal Appeared on 2 Jan 26, No Exit Signal Yet

About Taiwan Semiconductor Manufacturing Co

TSM is the world’s largest dedicated semiconductor foundry, producing advanced chips for global clients including Apple, Nvidia, and AMD. It plays a critical role in the tech supply chain, with leadership in cutting-edge nodes such as 3nm

Fundamental

TSMC’s 2025 rally has been underpinned by explosive AI and high-performance computing (HPC) demand, with Q3 revenue up ~41% y/y and earnings beating expectations by ~11%.

HPC which includes AI accelerators for Nvidia and AMD – now contributes about 57% of sales, driving margin expansion and a rise in ROE.

Management is leaning hard into this trend: CapEx is guided at US$40–42B for 2025 with a path toward ~US$50B in 2026–27, supporting capacity for 3nm and next-generation 2nm and A16 (1.6nm) nodes. 3nm already accounts for ~23% of revenue, is fully booked, and 2nm is expected to start contributing meaningfully from 2026, lifting pricing and margins further.

Advanced packaging (CoWoS) is another key leg of the story, already approaching ~10% of group revenue and growing faster than the company average, reinforcing TSMC’s systems-level moat in AI chips.

Technical

Prices rebounded from the 270,00 psychological support continuing its sideways pattern since September 2025

With the 310.00 resistance consistently being watched by sellers, profit taking may once again happen as prices approach this level.

With the 100d moving average intersecting with the 270.00 support, this remains a key support to be watched where bargain hunting could happen

A break above the 310.00 resistance could see a new higher support being formed where higher target of 340.00 would be possible

Recent News (Click to Read)

INTERNATIONAL BUSINESS MACHINES (IBM.NY)

Target Price: US$350.00

International Business Machines (TradingView)

1GT Bullish Signal Appeared on 21 Nov 25, No Exit Signals Yet

About International Business Machines

International Business Machines Corp. is an information technology company, which engages in the provision of integrated solutions that leverage information technology and knowledge of business processes.

It operates through the following segments: Software, Consulting, Infrastructure, Financing, and Others.

Fundamental

IBM’s AI and hybrid-cloud story has been reshaped by its planned US$11 billion all-cash acquisition of Confluent (CFLT), the leading commercial steward of Apache Kafka.

The deal, priced at US$31/share, implies roughly US$10.1 billion in enterprise value, or about 8.7× FY2025 EV/Sales – a ~34% premium to Confluent’s pre-announcement valuation.

Strategically, Confluent plugs a key gap in IBM’s stack by providing the real-time data-streaming layer that sits underneath Red Hat OpenShift, HashiCorp and watsonx, effectively acting as the “nervous system” for IBM’s hybrid cloud and AI platform.

Technical

Prices rebounded after dipping below the 290.00 support in November, prices quickly recaptured the support where the 20d moving average had started to move sideways

Longer term uptrend remains intact with the 100d and 200d moving average still moving sideways

As long as the support holds, prices could enter a consolidation phase with immediate resistance being around the 320.00 level

Any bullish price actions above the 320.00 level could see target raised to 350.00 first, signaling more upside for IBM.

Recent News (Click to Read)

WALMART INC (WMT.NQ)

Target Price: US$120.00

Walmart Inc (TradingView)

1GT Bullish Entry Signal Appeared on 20 Nov 25, No Exit Signal Yet

About Walmart Inc

Walmart Inc. is a leading multinational retail corporation headquartered in Bentonville, Arkansas

The company serves approximately 255 million customers weekly, offering a wide range of products and services at everyday low prices

Walmart's strategic focus on low prices, technological innovation, and expanded services positions it well to maintain its leadership in the global retail market

Fundamental

Despite macro headwinds and stiff competition from Amazon, Walmart’s fundamentals remains strong

Revenue grew 4.7% year-on-year in Q2 FY26 to $177.4 billion, while margins remained stable thanks to prudent inventory management and strong pricing discipline

Its core low-cost, high-volume strategy continues to attract cost-conscious consumers, while growth in Walmart+ membership, digital advertising, and e-commerce is boosting higher-margin income streams.

Financially, Walmart boasts robust cash flows, manageable debt (Net Debt/EBITDA of just 0.8x), and a 51-year track record of dividend increases—underscoring its operational and capital strength

Technical

Latest 1GT Bullish signal appeared as prices broke and held above the 104 resistance to form a new support

Quickly climbing above the 112.00 resistance, where a new temporary support had formed, prices are approaching the target of 120.00 where profit taking could take place.

With the 3 moving averages still showing strength, a bullish move above the 120.00 resistance could have higher targets being drawn.

A healthy consolidation could happen at the higher range as well within the 112.00 - 120.00 range.

Recent News (Click to Read)

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Conditions