- Joey Choy Top Stocks

- Posts

- Materials on the Move: 3 Giants Riding the Sector Surge

Materials on the Move: 3 Giants Riding the Sector Surge

3 heavyweight stocks catching investor attention

A Quiet Outperformer: The Basic Materials Sector

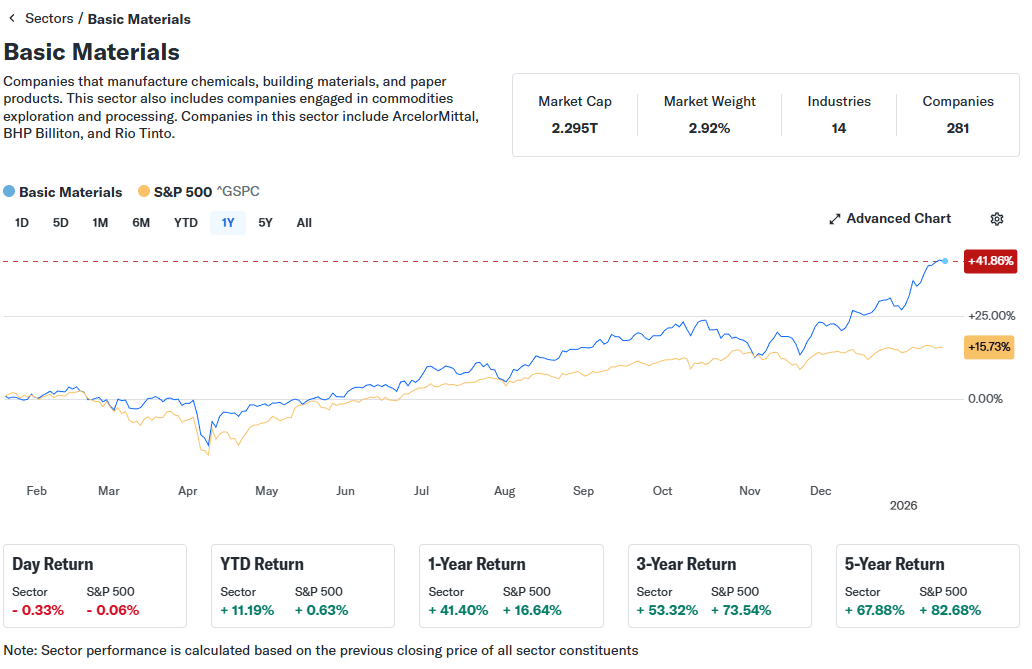

Basic Materials Sector Overview (Yahoo Finance)

While tech stocks often dominate headlines, the basic materials sector has quietly been on a tear. Looking at the 1-year chart from Yahoo Finance, basic materials have returned +48.21%, easily outpacing the S&P 500’s +19.74%.

This outperformance is largely driven by renewed demand in chemicals, metals, mining, and construction materials. And when a sector is strong, smart investors zoom in on the biggest names in that space.

Let’s take a closer look at the 3 largest players in the sector by market cap…

🧪 Linde (LIN): The Chemical Powerhouse

Linde

💰 Market Cap: $207.4B

🔬 What It Does: Linde is the largest industrial gas company in the world, supplying gases and services to a wide range of industries, from healthcare and food processing to electronics and manufacturing..

📈 What to Know:

Linde's Q4 results were solid, with strong project backlogs and continued global demand for clean hydrogen and industrial gases.

The company maintained its 2025 full-year EPS guidance at $16.35–$16.45, despite macro challenges, showing resilience.

Management highlighted new project wins and ongoing efficiency improvements, especially in Asia and Europe.

It’s also seen as a long-term player in clean energy and carbon capture, two areas with major future upside.

📊 Technical View: After hitting a low near $390 in December, LIN rebounded sharply, rising over 10% in just one month. It hints at a potential uptrend reversal, but more confirmation is needed from longer-term moving averages

⛏️ BHP Group (BHP): A Mining Giant

BHP

💰 Market Cap: $156.7B

🌎 What It Does: BHP is one of the world’s largest mining companies, producing copper, iron ore, coal, and other critical resources for global development.

📈 What to Know:

BHP’s latest earnings showed strong commodity prices and continued strength in iron ore, which accounts for a major share of profits.

The company emphasized operational discipline, capital efficiency, and a strong balance sheet, allowing it to return value to shareholders.

It also has exposure to copper, a metal increasingly seen as essential for electrification and EVs.

📊Technical View: Uptrend remains intact. The stock has flashed 3 consecutive bullish signals, and it’s now trading at multi-year highs. Momentum is strong, and trend-following investors may already be riding this wave.

🟠 Southern Copper (SCCO): Copper’s Crown Jewel

Southern Copper

💰 Market Cap: $139.7B

🔌 What It Does: Southern Copper is a major copper producer with mining operations in Peru and Mexico. Copper is a vital metal for everything from construction to EV batteries.

📈 What to Know:

SCCO posted strong Q3 earnings, driven by rising copper prices and higher output.

The company is focusing on long-term expansion projects to boost production capacity.

As global electrification trends accelerate, copper demand is expected to soar, positioning SCCO for continued tailwinds.

📊Technical View: SCCO has seen a 15%+ surge in just two weeks. With the uptrend firmly intact, the stock may need to cool off. Watch for price stabilisation and new support levels before jumping in, as chasing highs can be risky.

Final Take: Big Names, Big Moves

The materials sector isn’t always the most exciting but lately, it’s been quietly outperforming.

With strong price action, growing global demand, and renewed interest in industrials and metals, these 3 giants (Linde, BHP, and SCCO) are worth keeping an eye on.

As always, remember to do your own due diligence research and apply risk management to guide your decisions. If this trend continues, the materials story may just be getting started.

Hope you have found the above stocks useful 😃

If you have yet to be a part of Joey’s VIP clients in Phillip Securities receiving his Exclusive WhatsApp Broadcast daily, you can check it out here!

Joey and team post Top SG Stock Ideas, Market Updates, Research Reports and training videos on a daily basis at NO additional cost.

Look forward to see you on the inside!

- Joey, Bervyn & Zee

Sources:

1. Largest companies by market cap in the materials sector Available at: https://www.fool.com/research/largest-materials-companies/

2. Southern Copper Corporation (SCCO) Q3 2025 Earnings Call Transcript. Available at: https://seekingalpha.com/article/4834870-southern-copper-corporation-scco-q3-2025-earnings-call-transcript

3. BHP Group Limited (BHP) Q4 2025 Earnings Call Transcript Available at: https://seekingalpha.com/article/4836352-bhp-group-limited-bhp-q4-2025-earnings-call-transcript

4. Linde targets $16.35–$16.45 full-year EPS as project backlog remains robust amid macro challenges. Available at: https://seekingalpha.com/news/4512540-linde-targets-16_35-16_45-full-year-eps-as-project-backlog-remains-robust-amid-macro

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Condition