- Joey Choy Top Stocks

- Posts

- Micron Is Quietly Becoming The AI Boom’s Next Billion-Dollar Winner

Micron Is Quietly Becoming The AI Boom’s Next Billion-Dollar Winner

While Nvidia steals the spotlight, Micron’s memory chips are powering the AI revolution behind the scenes

Everyone is talking about AI stocks like Nvidia and Microsoft. But there’s one company quietly playing a very important role in the AI revolution: Micron Technology (NASDAQ: MU). Without Micron’s memory chips, much of today’s AI wouldn’t even work. And now, in 2025, Micron’s big bet on AI is finally starting to pay off.

Micron’s Big Bet on High Bandwidth Memory (HBM)

Micron’s biggest growth story right now is something called High Bandwidth Memory (HBM). This special type of memory helps AI models process huge amounts of data very quickly. Almost every major AI chip made by Nvidia, AMD, and others needs HBM.

In 2025, Micron hit a big milestone: it made over $1 billion in HBM sales in one quarter. The demand for HBM is so strong that Micron is already sold out for the rest of 2025, and it’s signing deals for 2026.

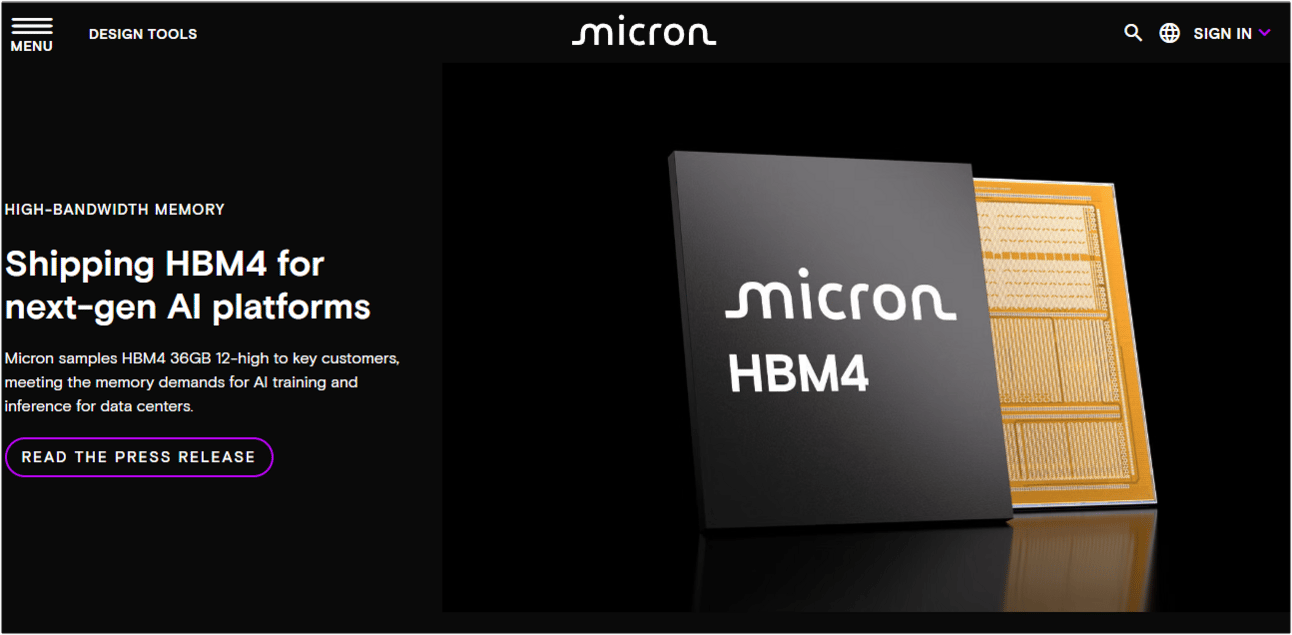

Micron’s latest version, called HBM3E, is being used in some of the most powerful AI chips in the world. Next year, Micron will launch HBM4, which will be even faster. Experts think the HBM market could grow from about $16 billion today to $100 billion by 2030 — and Micron plans to capture a big part of that growth.

sg.micron.com

Micron’s Two Main Businesses: DRAM vs NAND

Micron makes two main types of memory: DRAM and NAND.

DRAM makes up about 75% of Micron’s sales. This part of the business is doing very well, thanks to AI. DRAM prices crashed in 2023 but have now bounced back strongly.

NAND (used for storage like SSDs) is still weak. Prices are low, and there’s too much supply. Micron has cut NAND production by 10% to try to fix this. But for now, DRAM and HBM are driving most of Micron’s growth.

Earnings Snapshot

Micron’s numbers show how much the AI boom is helping:

Q3 FY2025 revenue: $9.3 billion (vs $8.87B expected)

Gross margin: 39.0%

Diluted Earnings per share (EPS): $1.91

Net capital expenditure: $2.7 billion

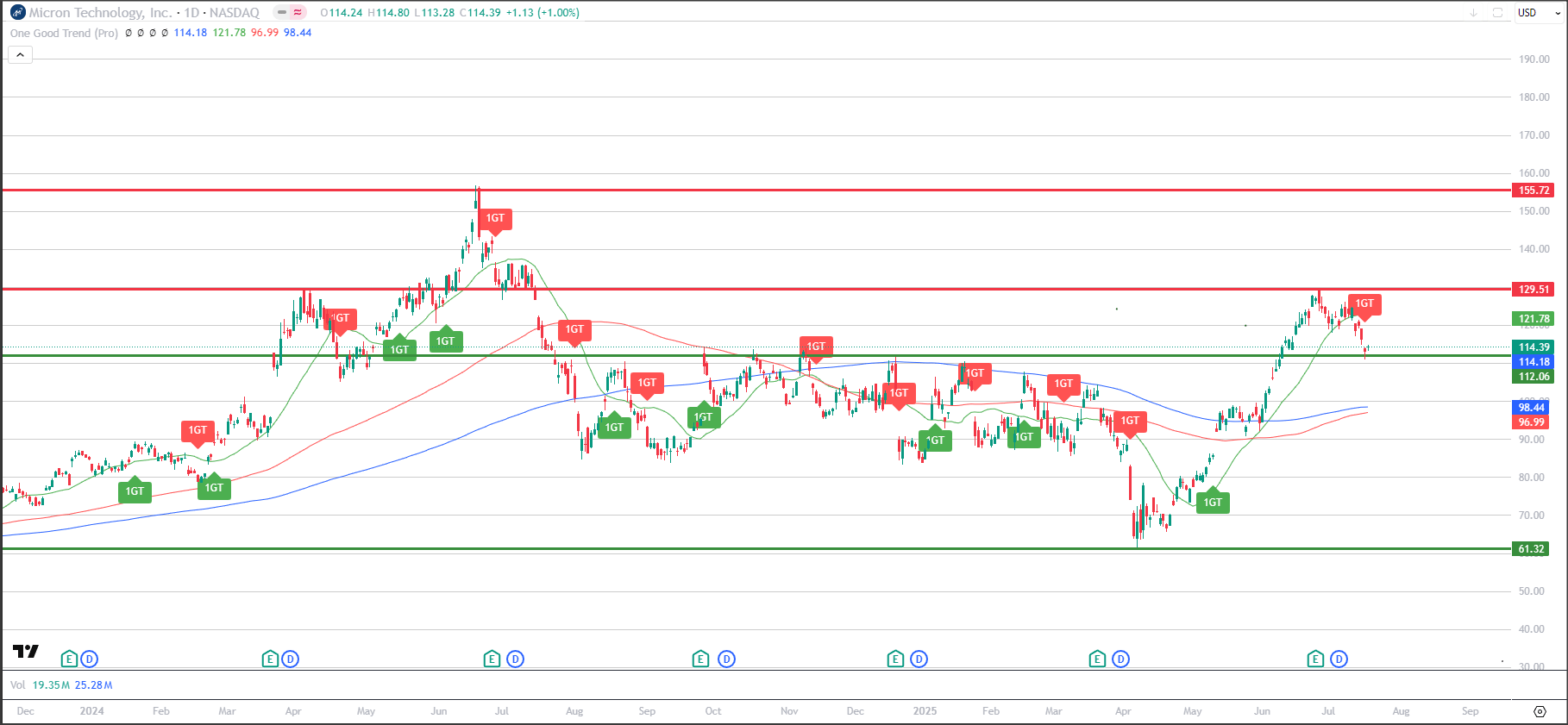

Technical Outlook: Chart Analysis on MU

Micron, MU (TradingView)

Price has recently approach the immediate resistance around 130, where profit-taking return

109 - 110 remain as one of the key support level to note as it was previously a resistance from Aug 2024 to Jun 2025

100d MA (red line) is attempting to cross above 200d MA (blue line) and if that happens, it would affirm the longer-term uptrend

If price is able to break and hold firmly above 130, awaiting new 1GT Bullish Signal, potential upside target towards 157 first

The Bottom Line

Micron isn’t a household name like Nvidia or Microsoft. But it plays a key role in making AI work. Without Micron’s fast memory chips, many AI models couldn’t run at all.

Thanks to strong demand for AI chips, Micron’s sales are growing fast. Even though there are still risks, many investors believe Micron is becoming one of the best long-term plays on AI’s continued growth. While others are grabbing the headlines, Micron is quietly building the memory that powers the AI revolution.

Hope you have found the above stocks useful 😃

If you have yet to be a part of Joey’s VIP clients in Phillip Securities receiving his Exclusive WhatsApp Broadcast daily, you can check it out here!

Joey and team post Top SG Stock Ideas, Market Updates, Research Reports and training videos on a daily basis at NO additional cost.

Look forward to see you on the inside!

- Joey, Bervyn & Zee

Sources:

1. Micron sees new Singapore plant as key in plan to meet rising demand for AI-enabling chips. Available at:

https://www.straitstimes.com/business/economy/micron-sees-new-singapore-plant-as-key-in-plan-to-meet-rising-demand-for-ai-enabling-chips

2. Why Micron Stock Dropped Today. Available at:

https://www.fool.com/investing/2025/07/17/why-micron-stock-dropped-today/

3. Micron reports earnings, revenue beat and issues strong forecast. Available at:

https://www.cnbc.com/2025/06/25/micron-mu-q3-2025-earnings-report.html

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Condition