- Joey Choy Top Stocks

- Posts

- November 2025 Newsletter

November 2025 Newsletter

Market Updates and Top Stock Picks from Singapore & US market

Hello everyone,

October proved to be a tale of two moods in the markets. On one hand, major U.S. indices like the S&P 500 and Dow Jones Industrial Average reached fresh record highs as investor optimism gathered behind signs of easing policy and resilient earnings.

As we move into November, it’s a great time to remain selective, focusing on companies that deliver real earnings and cash flow, while being mindful of the macro tail-risks (geopolitics, policy shifts, bond markets) that could shift momentum quickly.

Your No.1 Fan,

Joey Choy

Market Overview

Singapore

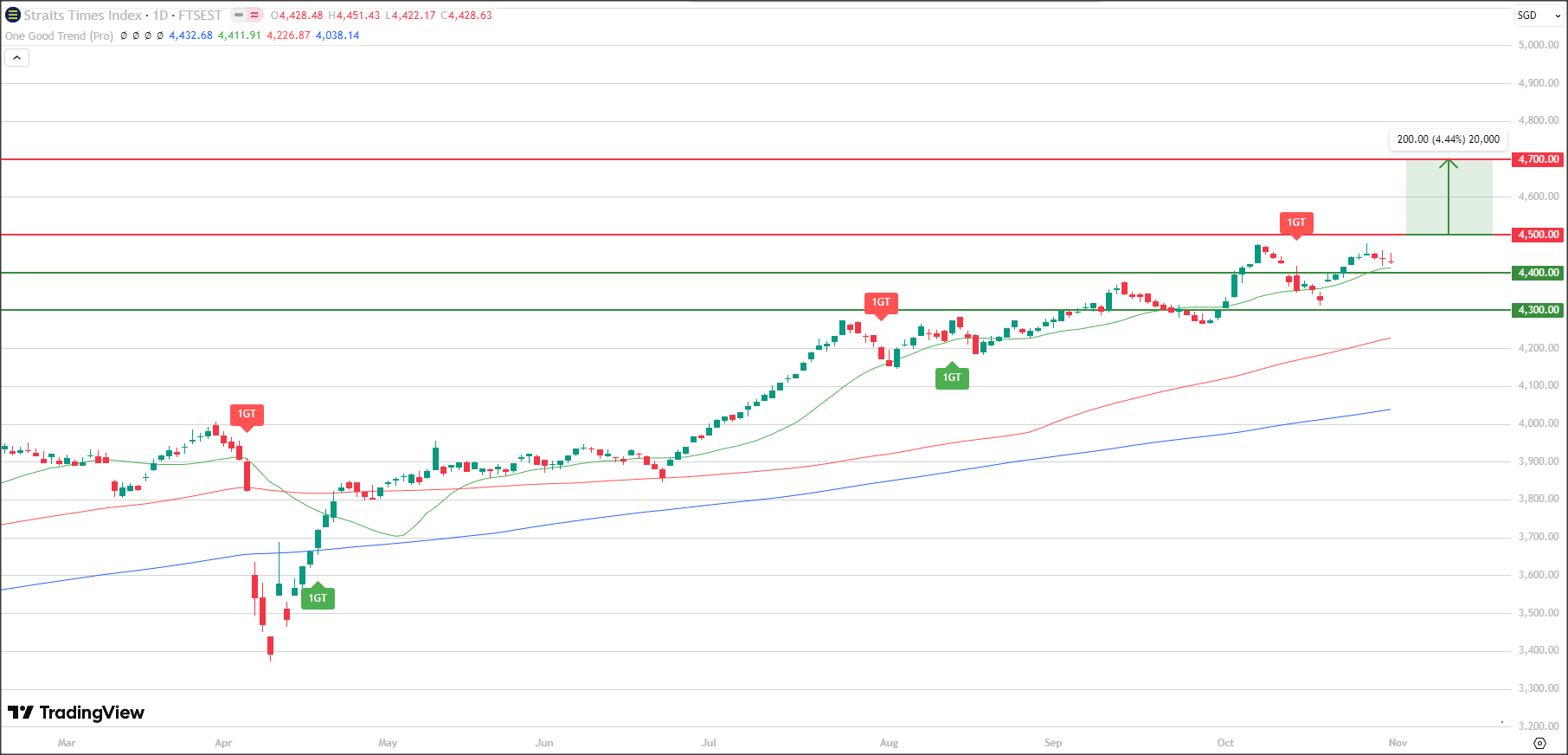

Straits Times Index (TradingView)

Straits Times Index (STI) is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

Export momentum remains a double-edged sword: Singapore’s non-oil domestic exports rose 6.9% y/y in September, reversing an earlier decline, however some economist remain wary of potentially weakening momentum looking forward.

The Singapore Exchange (SGX) is seeing renewed interest, retail participation is up, IPOs are rising, signaling improved market depth. Caution is also creeping in among local investors. A survey finds 28% of Singapore investors say they’re now investing more conservatively, up from 20% a year ago.

Financials and large cap names continue to be market anchors but their upside may be limited unless macro improves meaningfully. Mid-cap and small-cap names (especially in sectors like industrials, logistics, real estate) may offer more upside, given renewed trading interest.

The STI continues to attempt to push new highs, briefly dipping below the 4,400 temporary support in mid-October, before rebounding from the 4,300 support.

20 day moving average continue to head upwards, alongside the 100 day and 200 day moving average, indicating continued strength in the index.

With near-term target drawn to the 4,500 resistance first, a break above this level could see a new 1GT bullish signal emerge, where the next phase of the uptrend could continue potentially testing the 4,700 resistance.

Hot News (Click to read):

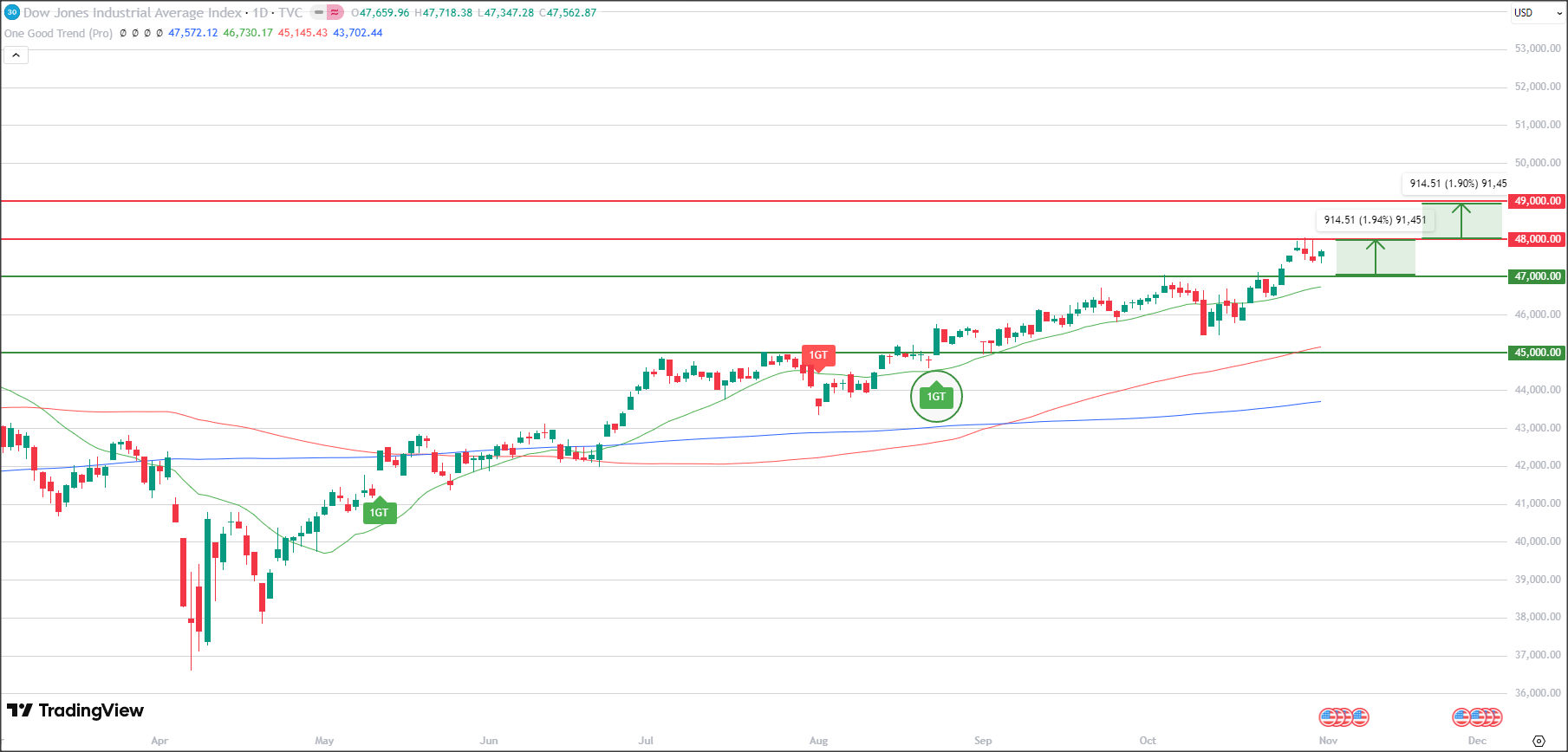

Dow Jones Industrial Average (TradingView)

Dow Jones Industrial Average (DJIA) tracks the daily price movements of 30 large, public-owned blue-chip American companies.

After seeing weakness early October, the index quickly rebounded close to the 45,000 support level, continuing its push toward the 47,000 level and breaching it, turning it into a support. With the next target at 48,000 level, the index continues to mark new highs, moving averages pointing up, this uptrend could continue toward the end of 2025.

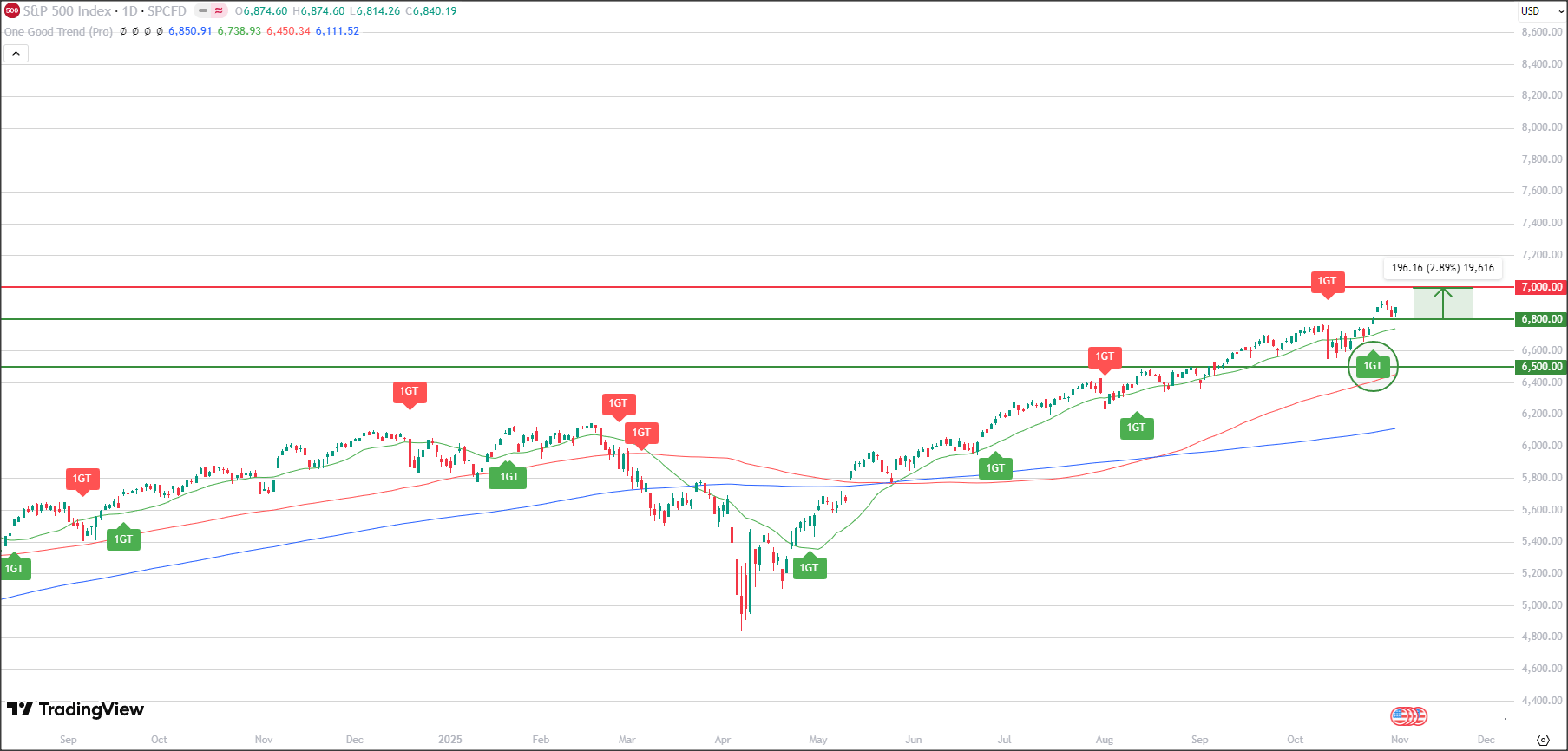

S&P 500 (TradingView)

S&P 500 Index is a market-capitalization weighted index of the 500 leading companies in the US which is widely considered as one of the best gauge of the US economy.

Similar to the Dow Jones Industrial Average, the index quickly recovered after a brief episode of weakness in October, and recently breaking the 6,800 resistance, turned support. With the Immediate resistance around the 7,100 psychological resistance representing a new high for the index.

External shocks remain a risk, renewed tariff threats from the U.S. to China triggered a sharp single-day drop (~2.7% for S&P500) in October.

A government shutdown in the U.S. since early October has disrupted economic data flows and added to “macro fog”, increasing uncertainty about the timing of future rate moves.

With broad indices near highs and risk still elevated, focus is best placed on companies with strong fundamentals, earnings visibility, and cash-flow resilience.

Hot News (Click to read):

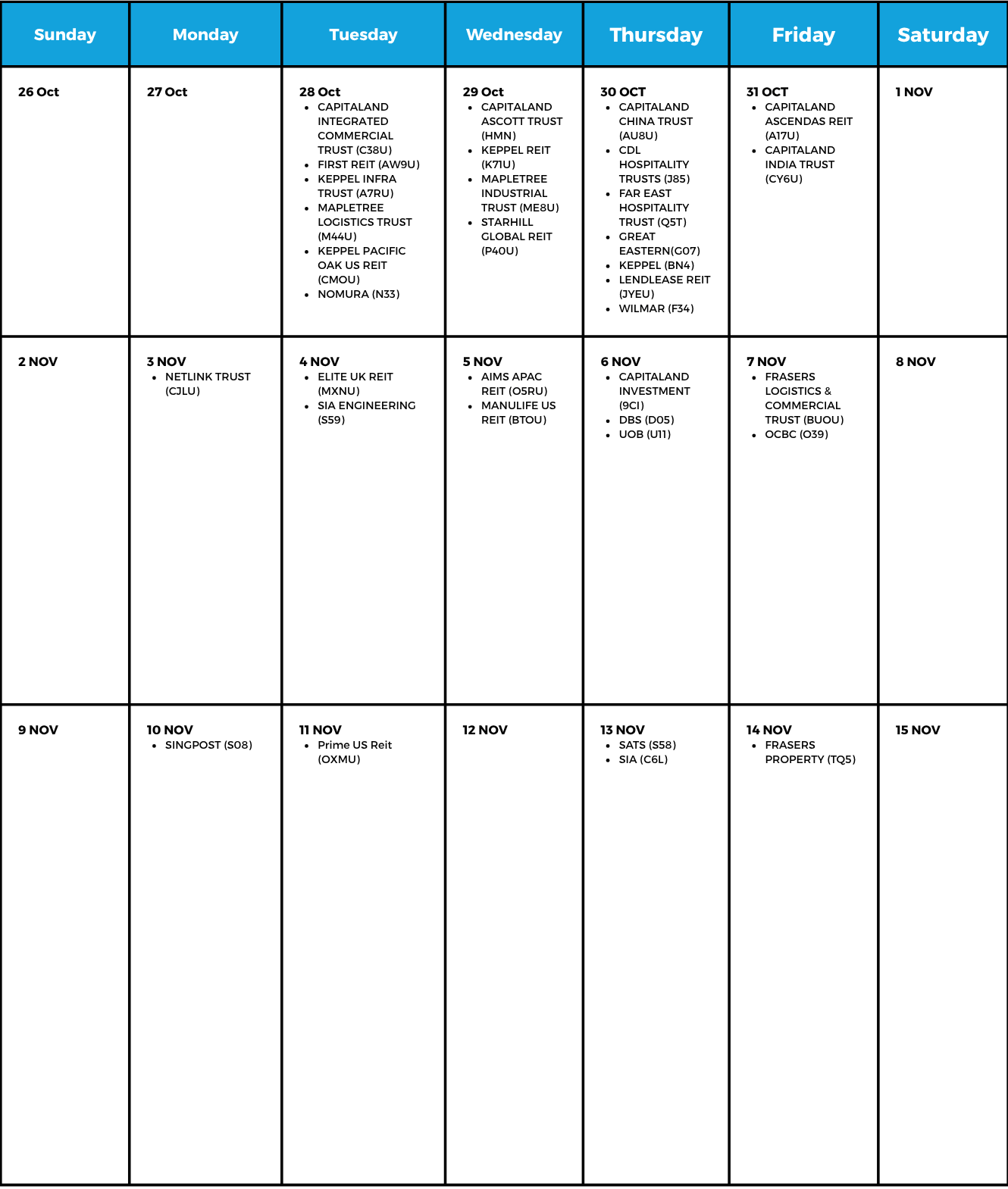

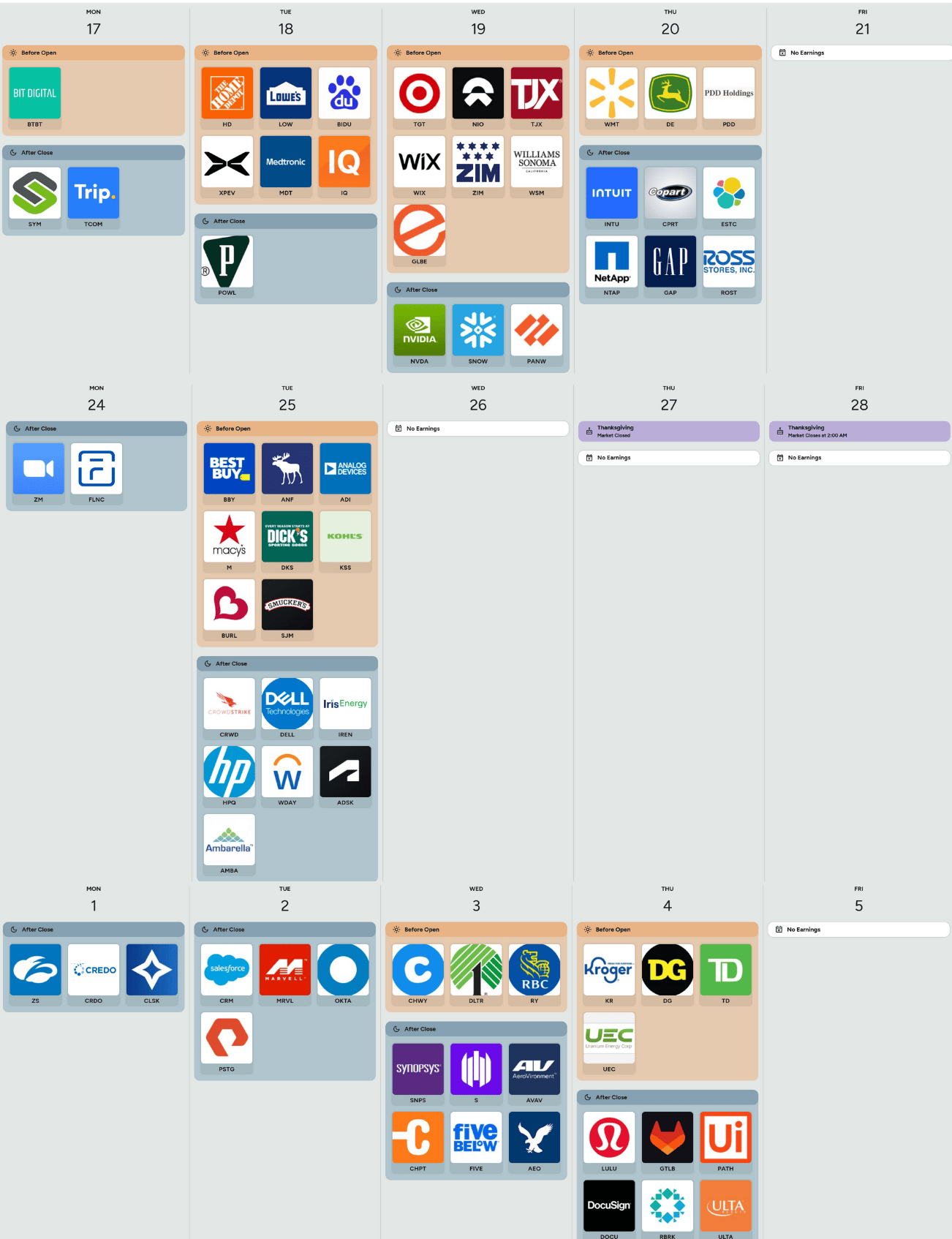

Singapore Earnings Calendar

Note that the below information is taken from the dates displayed on TradingView and SG Investors IO. The below calendar is not exhaustive, it is indicative only. Please refer to SGX Announcement for exact dates & timings.

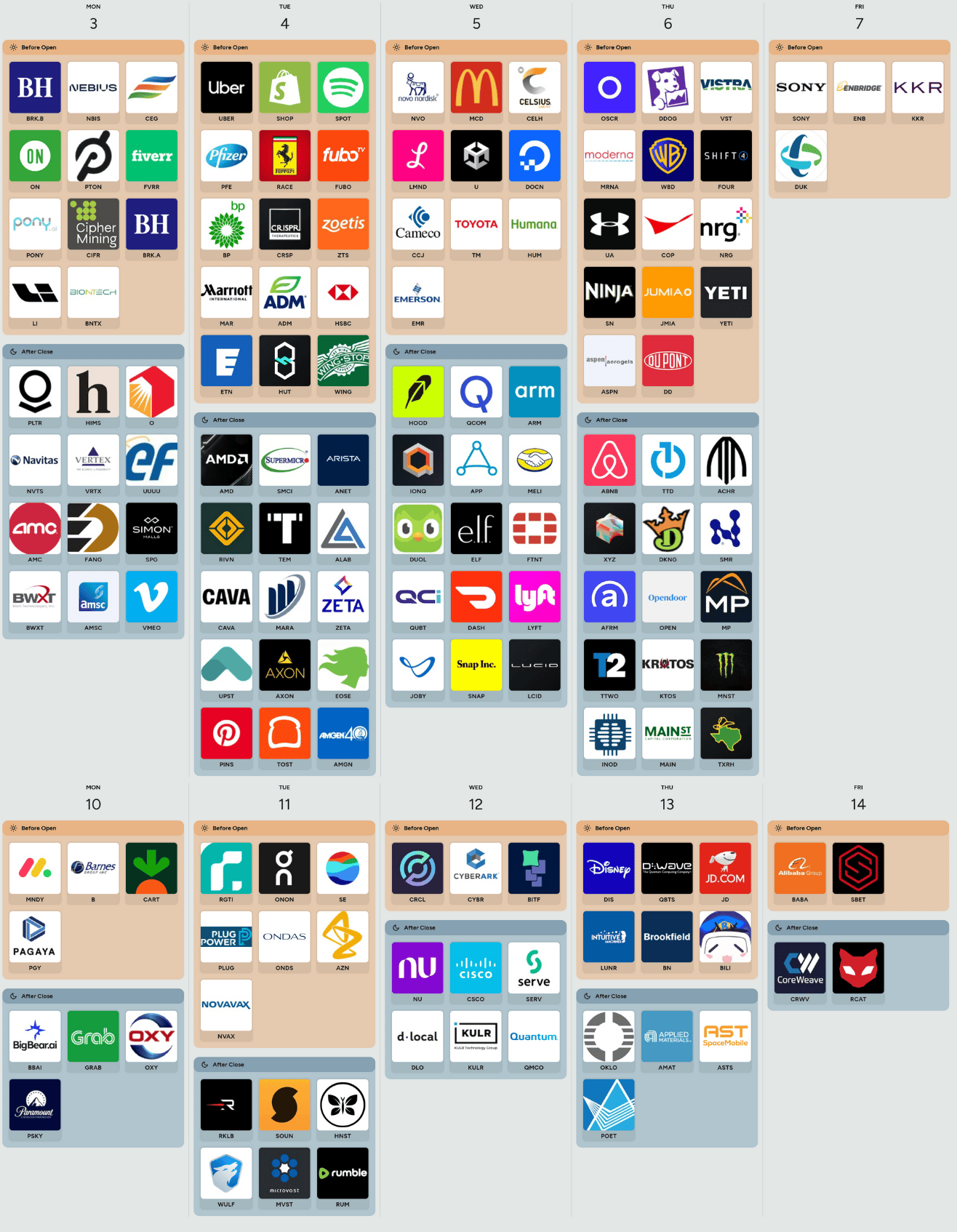

United States Earnings Calendar

Note that the below information is taken from the dates found on Earnings Whispers and Nasdaq. We've exclusively chosen stocks favored by investors with widely recognized names. The below calendar is not exhaustive. Please refer to Earnings Hub & Nasdaq for the full list.

Singapore Stocks Spotlight

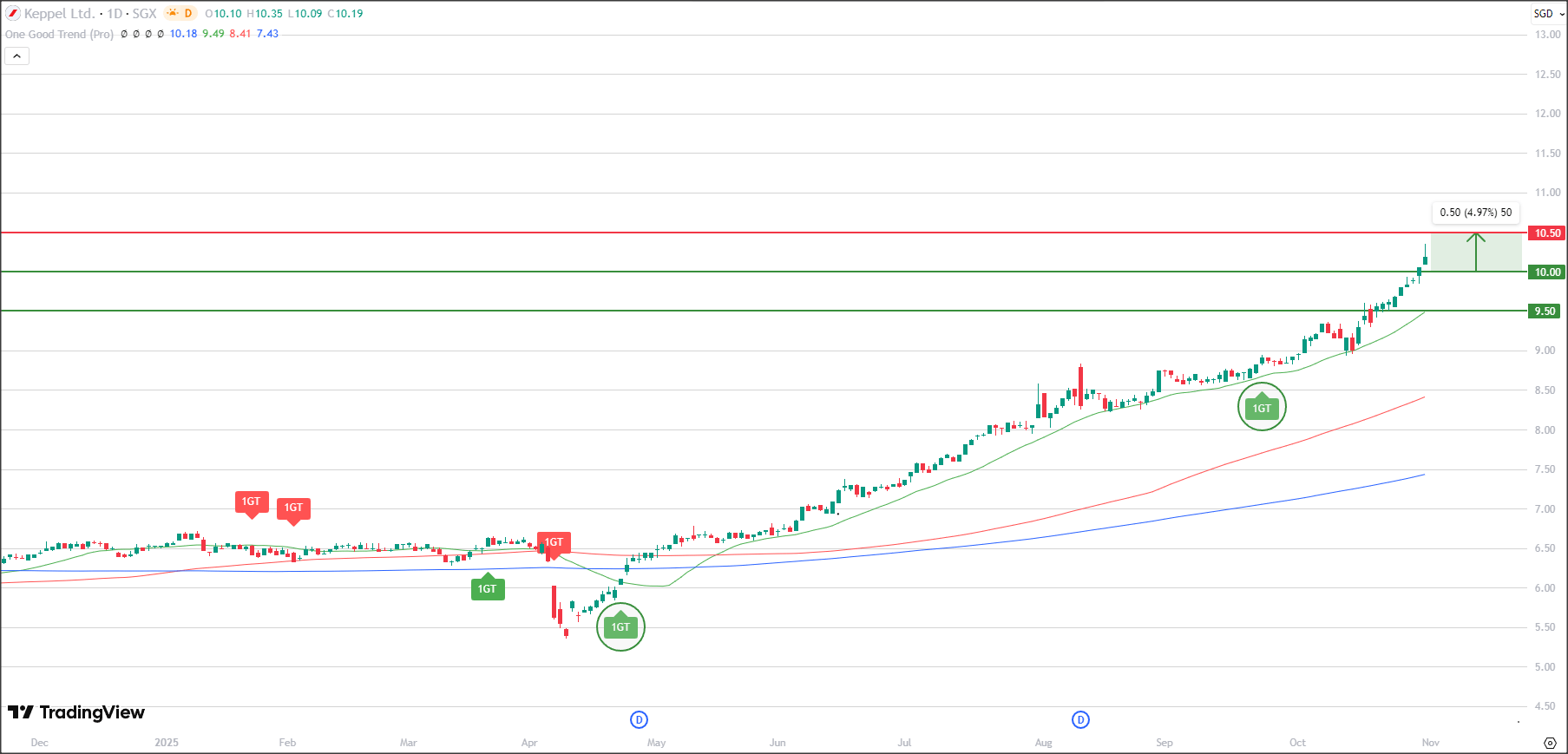

KEPPEL (BN4.SI)

Target Price: S$10.50

Keppel (TradingView)

1GT Bullish Entry Signal Appeared on 23 Sep 25, No Exit Signal Yet

About Keppel

Keppel Corporation is a diversified conglomerate operating across infrastructure, real estate, renewables, and asset management

The group’s business model has evolved toward an integrated asset management approach recycling capital through development, investment and monetisation activities

Fundamental

Keppel’s 1Q 2025 net profit (excluding legacy Offshore & Marine assets) rose by more than 25% y/y, supported by resilient infrastructure income and improving real estate contributions

Recurring income accounted for roughly 80% of group profit, highlighting its stable, fee-based earnings profile

Asset management fees grew 9% y/y to S$96m, while the group divested S$347m worth of assets year-to-date, with another S$550m in advanced negotiations

With over two-thirds of earnings derived from energy and connectivity, Keppel remains one of the more defensive blue chips amid market volatility

Technical

Price has recently broken above the 10.00 level, turning it into a new higher support

2 consecutive 1GT Bullish signals are still playing out with price holding above trailing support since Apr 2025

All 3 moving averages are still heading up, indicating that short-term and long-term uptrend remains intact

As long as price continues to hold above trailing support, initial upside target drawn towards psychological 10.50 first, where some profit-taking can return

Target to be raised higher if 10.50 is breached

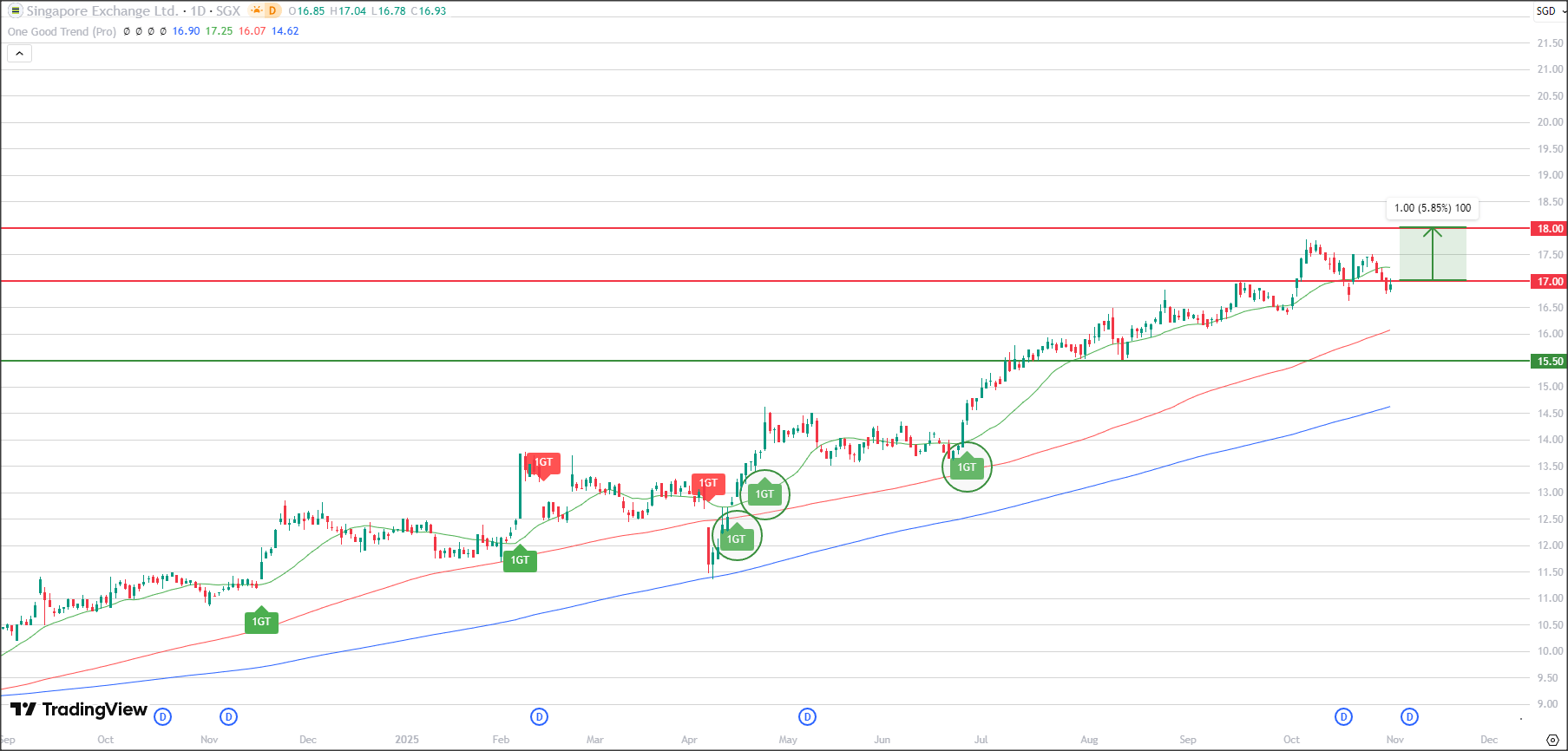

SINGAPORE EXCHANGE LTD (S68.SI)

Target Price: S$18.00

Singapore Exchange Ltd (TradingView)

1GT Bullish Entry Signal Appeared on 26 Jun 25, No Exit Signal Yet

About SGX

Singapore Exchange (SGX) is Asia’s leading multi-asset exchange, providing trading, clearing, settlement and data services across equities, fixed income, currencies, and commodities

It operates key business segments including Equities (Cash & Derivatives), Fixed Income, Currencies & Commodities (FICC), and Data, Connectivity & Indices (DCI)

Fundamental

SGX posted record revenue and profit for FY2025, with revenue rising 8% y/y to S$1.38 billion and net profit up 5% y/y to S$572 million

Growth was broad-based across asset classes, led by a 26% increase in cash equities revenue and steady expansion in derivatives and FICC trading

The group announced a final dividend of 10.5 cents, bringing the full-year payout to 37.5 cents, and guided a 0.25 cent quarterly increase per year from FY2026–FY2028

Management remains positive on trading momentum and market development opportunities as SGX cements its position as a multi-asset growth platform

Technical

Longer term uptrend remains intact as 100d and 200d MA are still heading upwards, while 20d MA is moving sideways

This is further supported by the 3 consecutive 1GT Bullish signals that are still playing out since Apr

Price has recently consolidating under the psychological 17.00 resistance level, and has rebounded from the trailing support in Oct

As long as price is able to continue holding firmly above trailing support, would not rule out more upside towards 18.00 first, where selling pressure could return

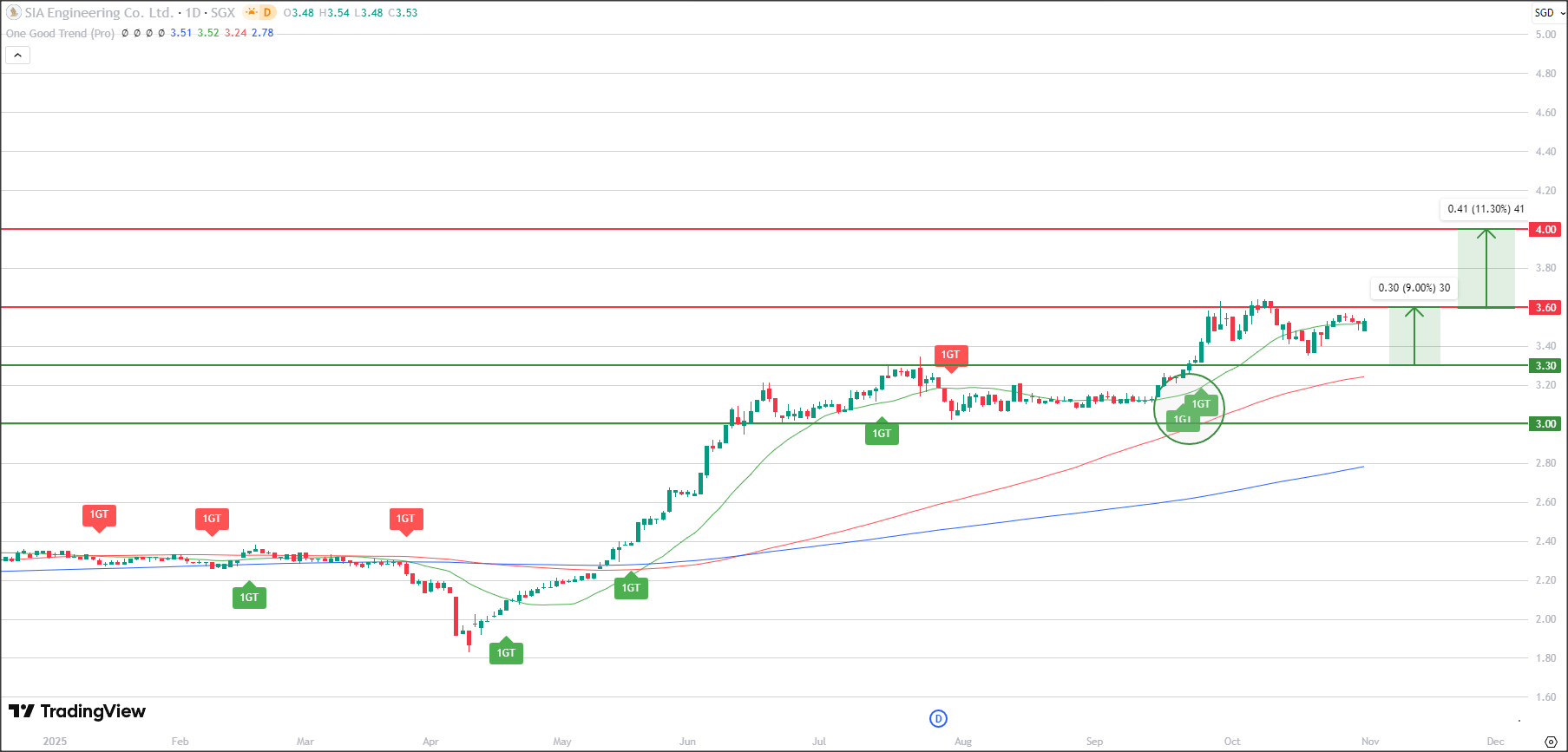

SIA ENGINEERING (S59.SI)

Target Price: S$3.60

SIA Engineering (TradingView)

1GT Bullish Entry Signal Appeared on 24 Sep 25, No Exit Signal Yet

About SIA Engineering

SIA Engineering is a leading provider of aircraft maintenance, repair, and overhaul (MRO) services, serving both Singapore Airlines and over 80 international carriers

The group operates through two key divisions: Airframe and Line Maintenance, which covers base maintenance, heavy checks, and on-wing support, and Engine and Component Services, delivered through long-standing joint ventures with global OEMs

Fundamental

SIA Engineering’s FY2025 results reflected continued recovery in global aviation activity. 1H FY25 net profit rose 12.5% y/y to S$80.4 million, supported by higher flight volumes, increased maintenance checks and growing third-party work

Revenue expanded 13% y/y to S$577 million, led by strong performance in line maintenance and engine overhaul

The company maintained a healthy net cash position of over S$500 million, giving flexibility for fleet capability upgrades and digital initiatives

Backed by steady recovery trends and cost discipline, SIA Engineering remains well-positioned to benefit from long-term fleet growth and higher maintenance cycles

Technical

Price has broke out of its 3 months sideway consolidation range above the 3.30 resistance level, turning it to become the new higher support to note

Subsequently, price has proceeded to consolidate higher between the range of 3.30 - 3.60, and 20d MA has also started to flatten out

Longer-term uptrend still remains intact with 100d and 200d MA still heading up

If price is able to break and hold firmly above 3.60 with 20d MA pointing up again, would not rule out more upside towards 3.90 - 4.00 as the next target

United States Stocks Spotlight

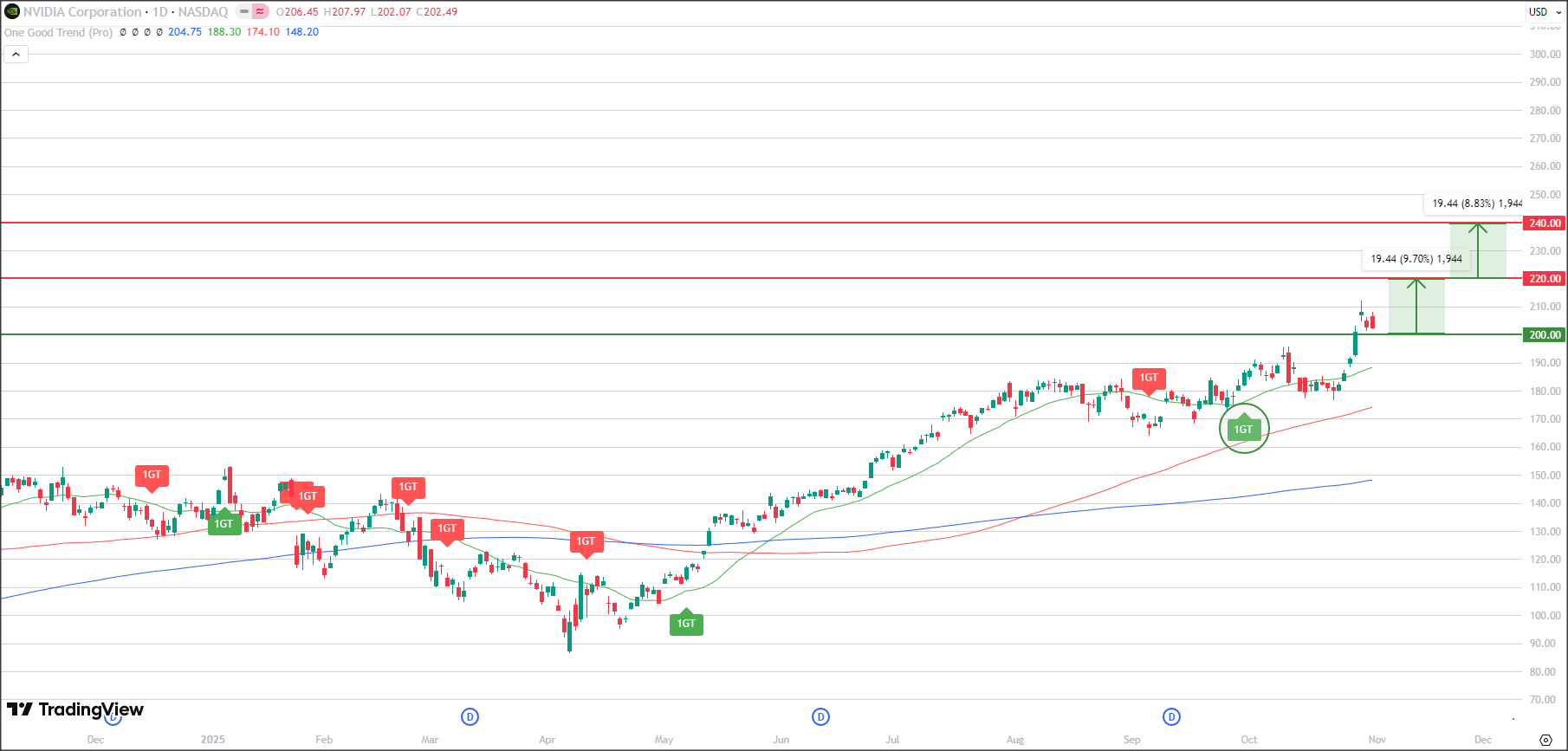

NVIDA CORP (NVDA.NQ)

Target Price: US$240.00

Nvidia Corp (TradingView)

1GT Bullish Entry Signal Appeared on 30 Sep 25, No Exit Signal Yet

About Nvidia Corp

NVIDIA Corp. engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software

It operates through the following segments: Graphics Processing Unit (GPU) and Compute & Networking

Fundamental

NVIDIA continues to set new records as AI investment accelerates globally. For Q3 FY2026, revenue surged 76% y/y to US$30.1 billion, led by a 105% increase in Data Center revenue driven by hyperscale demand from cloud providers and AI model training.

Gross margins expanded to ~74%, reflecting pricing power and a favorable mix toward high-end AI accelerators like the H200 and Blackwell architectures.

Free cash flow rose over 140% y/y to US$13.3 billion, underpinning massive shareholder returns through buybacks.

NVIDIA remains the first U.S. company to cross the US$5 trillion market capitalization mark, underscoring its leadership in the AI era. Management raised FY2026 guidance for low-double-digit sequential revenue growth and reiterated confidence in long-term AI infrastructure spending.

Technical

Prices broke the above the 200.00 resistance now turned support, where currently prices are consolidating

All 3 moving averages continuing to slope upwards, suggesting strength both in the longer term and shorter term

Immediate resistance around 220.00 where selling could return, where if broken could see longer term target toward 240.00

Recent News (Click to Read)

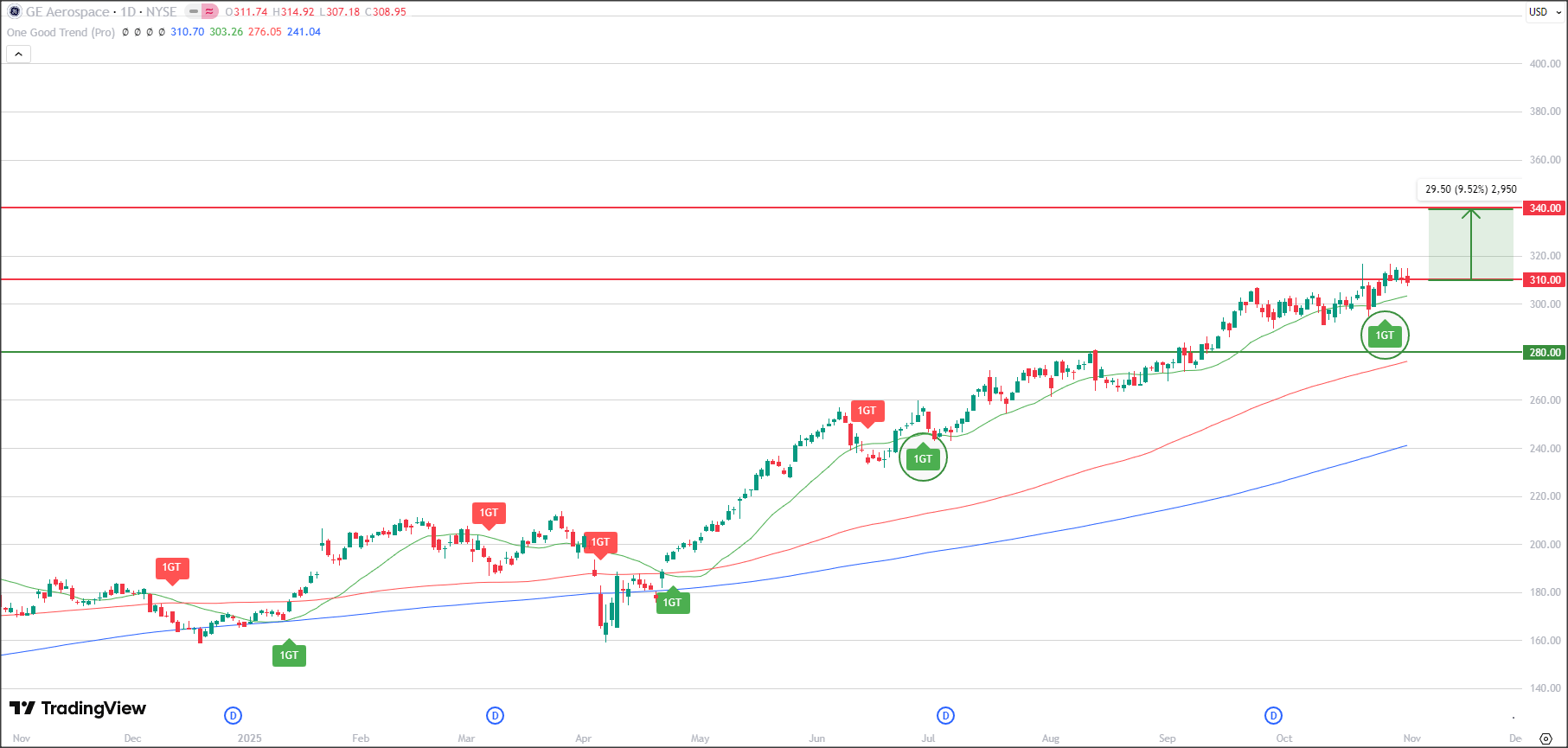

GE AEROSPACE (GE.NY)

Target Price: US$340.00

GE Aerospace (TradingView)

1GT Bullish Signal Appeared on 27 Oct 25, No Exit Signals Yet

About GE Aerospace

GE Aerospace designs, manufactures, and services commercial and military aircraft engines, systems, and components

Formerly part of General Electric before its 2024 spin-off, the company now operates as a pure-play aerospace leader with strong exposure to both civil and defense markets

Fundamental

GE Aerospace reported another strong quarter, with Q2 2025 revenue rising 23% y/y to US$10.2 billion and operating profit climbing to US$2.3 billion on higher aftermarket demand and improved pricing

The company’s backlog expanded to US$175 billion, providing long-term visibility supported by robust demand for commercial engines and MRO services

Free cash flow nearly doubled to US$2.1 billion, reflecting strong conversion

Management raised its FY2025 guidance to mid-teens revenue growth and free cash flow of US$6.5–6.9 billion, with EPS projected between US$5.60–5.80. Analysts note GE’s leading 55% global market share in aircraft engines (including Safran JV) and strong pricing power as reasons the stock’s premium valuation remains justified

Technical

Prices currently testing the 310 level, attempting to break above it, turning it into a new higher support

20d MA has also started to point back up again after a period of sideway consolidation, aligning with longer-term trend (100d and 200d MA), indicating that uptrend remains firmly intact

Potential bargain hunting near trailing support zone

As long as price is able to continue holding firmly above 310, would not rule out more upside towards 340, where profit-taking could return

Recent News (Click to Read)

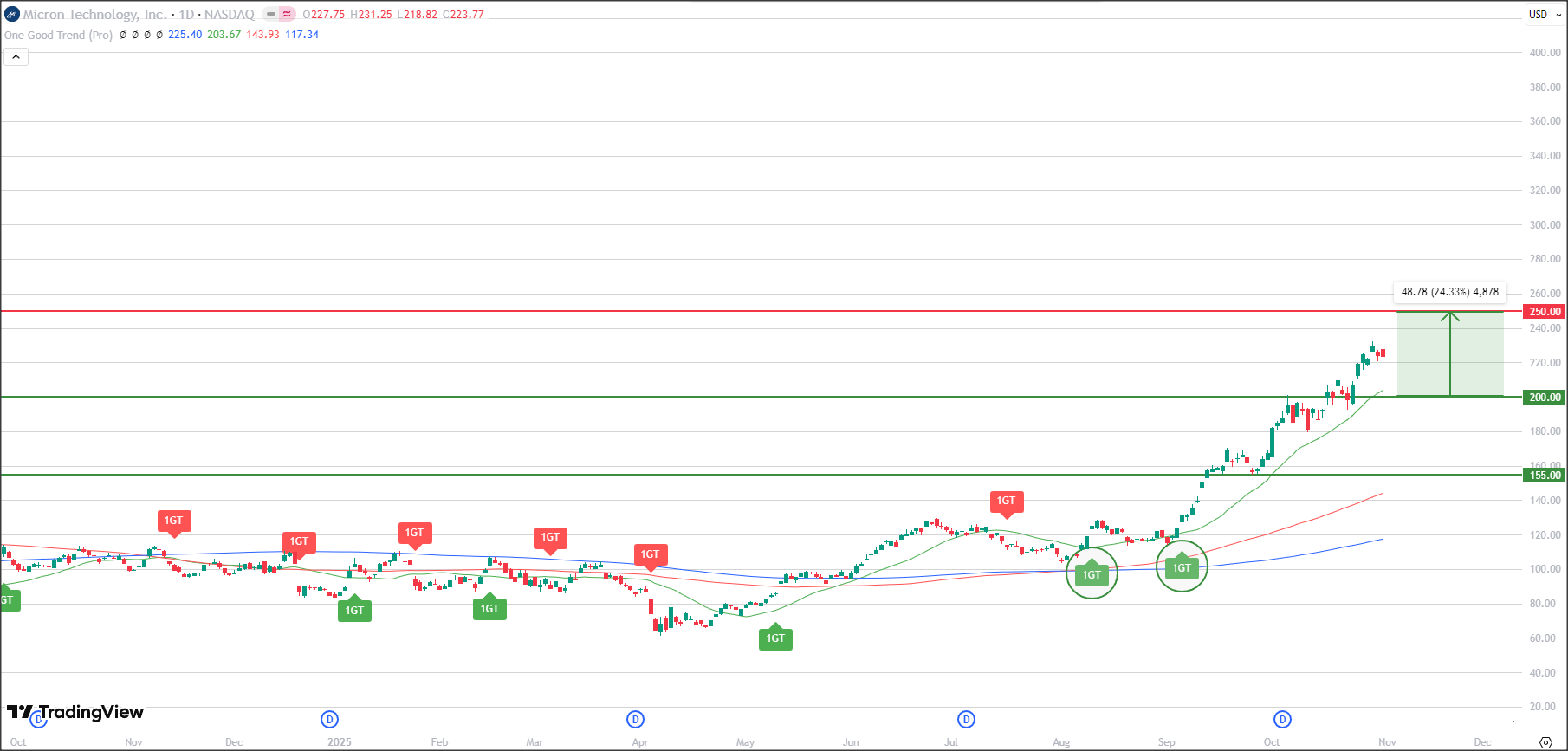

MICRON TECHNOLOGY (MU.NQ)

Target Price: US$250.00

Micron Technology (TradingView)

1GT Bullish Entry Signal Appeared on 5 Sep 25, No Exit Signal Yet

About Micron Technology

Micron Technology is one of the world’s leading manufacturers of semiconductor memory and storage solutions, specializing in DRAM, NAND and NOR flash technologies

Its products are essential to a wide range of devices, from smartphones and PCs to data centers and AI accelerators

Fundamental

Micron posted a strong rebound in FY2025 as the memory market entered a recovery phase following two years of price compression

Q4 FY25 revenue rose 73% y/y to US$8.9 billion, marking its second consecutive profitable quarter, driven by rising DRAM prices and robust demand from AI servers

Gross margin expanded to 32% from 18% in the prior quarter, supported by higher utilization and pricing power. Data center demand remains the key growth driver, with AI workloads fueling high-bandwidth memory (HBM3E) adoption

Micron expects FY2026 CAPEX of US$8–8.5 billion, focused on advanced node ramp-up and packaging expansion

Management guided mid-teen percentage revenue growth for FY2026, reflecting confidence in sustained AI-driven demand

Technical

Price has recently found a new higher psychological support around 200

All 3 moving averages are still firmly heading upwards, with 2 consecutive 1GT Bullish signals still in play and trailing support continues to trail the price as it moves higher

Immediate resistance zone appears to be around 250, where selling pressure could return

As Micron is trading at a multi-year high, remember to take steps to protect your profits while continuing to ride the uptrend

Recent News (Click to Read)

Note that by subscribing to receive any of Joey's training by email, you agree to allow us to send you the training by email. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products. By Accessing this Website and ANY of its pages, you are agreeing to the terms set out ON ALL the following pages as seen below. Copyright © | Joey Choy | All Rights Reserved | Disclaimer | Privacy & Security Policy | Terms and Conditions