- Joey Choy Top Stocks

- Posts

- OCBC at New Highs: Is the Trend Still Intact?

OCBC at New Highs: Is the Trend Still Intact?

The chart is setting up for a potential continuation

Executive Summary

OCBC Bank (O39.SI) has staged a strong breakout above the $18.70–$19.00 resistance zone, pushing the stock to fresh highs and reinforcing the broader uptrend that has been in place for most of the year. After clearing this key level, prices have held firm, suggesting that buying momentum remains intact rather than exhausted. With 1GT Bullish signals still in play and the stock consolidating near its highs, the chart continues to point toward a potential extension of the move if momentum sustains.

Beyond the technical picture, investor sentiment toward OCBC has improved on the back of its resilient wealth management franchise, growing fee income, and expectations of higher shareholder returns ahead. Recent commentary around dividend optionality and Singapore equity market reforms has further supported interest in the stock. As long as prices remain above the former resistance-turned-support zone, traders will be watching closely to see if OCBC can make a decisive push toward the $20.00 level next.

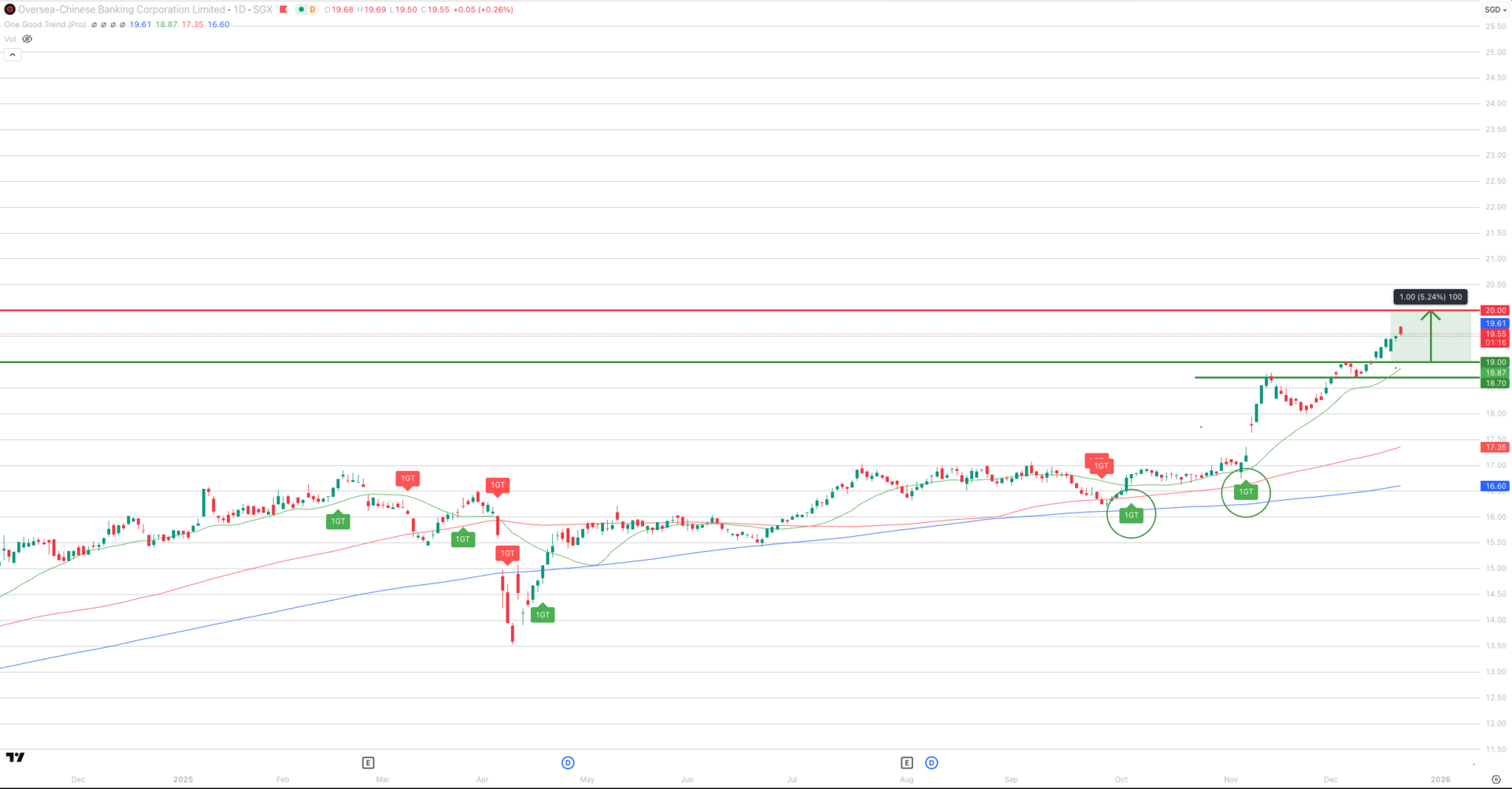

OCBC Bank (TradingView) – 19 Dec 2025

Oversea-Chinese Banking Corporation (O39.SI) remains one of Singapore’s strongest banking franchises, backed by solid capital buffers, resilient net interest margins, and diversified income streams across wealth management and insurance.

Despite periods of volatility earlier in the year, OCBC has continued to trade within a well-defined long-term uptrend, with recent price action suggesting that momentum may be building again.

OCBC continues to trade above its 200-day moving average (blue line), which has been steadily rising. This indicates that the primary uptrend remains intact. The 100-day moving average (red line) is also trending upward, reinforcing the broader bullish structure.

Historically, OCBC has attracted strong buying interest whenever prices retraced toward these longer-term averages. This pattern repeated itself earlier in the year, where the stock found firm support before resuming its climb.

OCBC has staged a decisive move above the $18.70 resistance recently, a level that had capped prices in November. This breakout was followed by a brief consolidation, allowing momentum to reset before pushing higher again.

Prices are now holding comfortably above $19.00, which has turned into an important support zone. This successful retest suggests that buyers remain in control, and the stock may be preparing for another leg up.

The earlier 1GT Bullish signal in October near the 17.00 psychological resistance highlighted the potential strength, where the subsequent 1GT Bullish Signal in early November provided the additional layer of confirmation of the renewed strength.

As long as prices remain above the $18.70–$19.00 region, the 1GT bullish signals continue to play out.

Based on the current structure, OCBC offers two setups depending on your risk appetite:

For traders looking to position, a more conservative approach would be to accumulate on pullbacks toward the $18.70–$19.00 support zone, with a protective stop placed below this region should momentum fade.

Those with a more aggressive stance could consider entering on a confirmed break above $20.00, which would signal a continuation of the uptrend and potentially unlock the move toward $21.00.

So, how does one take a position in OCBC to ride the uptrend further with lower initial capital outlay?

Investors who wish to be exposed to potential upside moves in OCBC shares can consider using OCBC call warrants to magnify the potential share price return using lesser capital outlay and without the risk of margin calls, while those bearish can use a put warrant. There are currently three call warrants tracking OCBC shares listed in the market and two put warrants. The trending warrants – meaning those with the tightest spreads and highest liquidity, are marked by the fire logo next their warrant codes. The warrant code is what you would enter into your trading platform should you wish to trade in the warrant.

Source: Warrant Search for OCBC underlying,

https://warrants.com.sg/tools/warrantsearch/?underlying=O39&maturity=all&expiry=all&type=all&effectiveGearing=all&indicator=all&moneyness=all&issuer=MBL

Whether one is looking to take on the more conservative bullish approach of buying an OCBC call warrant around the $18.70 to $19 support zone, or entering above $20, one can use the Warrant Selector.

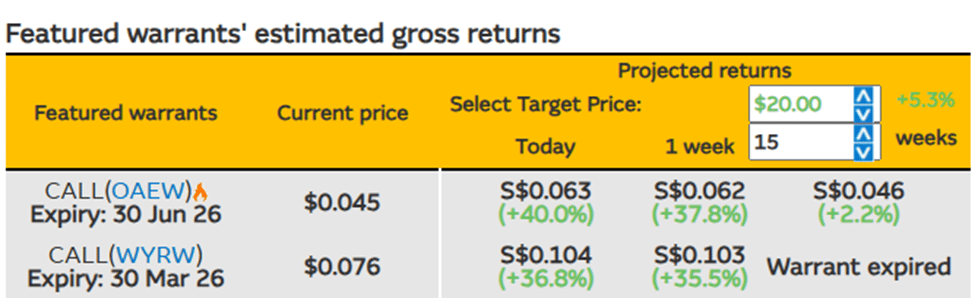

Scenario 1: Entering into a bullish position via OCBC call warrants when stock falls to $19.

Source: Warrant Selector for OCBC,

https://warrants.com.sg/tools/selector

1) Enter your desired entry level of $19.00 under the “Last price” field the price at which you intend to take a bullish position on OCBC shares. The current prices of the OCBC call warrants would in turn update to the bid price they would trade at should OCBC trade there today:

2) Type in the intended exit level of $20.00 and, 3) increase the number of weeks to observe how the SGX call warrants would perform:

In this case, assuming all factors remain unchanged, If OCBC took 4 weeks to increase 5.3% from $19.00 to $20.00, the first call warrant with a fire logo (i.e. the trending warrant) (https://warrants.com.sg/tools/livematrix/OAEW) will gain around 6.3 times more – 33.3% from SGD 0.045 to SGD 0.060, while the second call warrant WYRW (https://warrants.com.sg/tools/livematrix/WYRW) will increase 5.7 times more i.e. +30.3% to SGD 0.099. Note that the Warrant Selector only displays the warrants with tight spreads (i.e. less than 3 ticks spreads between the bid and offer)

Investors should also note that the leverage in the warrants work both ways. If OCBC share price moves in the opposite direction and falls, the prices of these call warrants will move by a greater percentage than the share price move.

Keep increasing the number of weeks and one would find that by the 15th week, the percentage gains on the OAEW will erode to generate less returns compared to OCBC shares, while WYRW would have expired. This is due to the effect of time decay – the costs of holding a warrant, where the longer one holds onto the warrant, the higher the holding costs. The maximum holding period for both warrants is therefore less than 15 weeks from today.

For the second scenario of entering into a bullish OCBC position via the call warrants, one can simply repeat the above steps by updating the “Last price” to $20.00 and the exit price to $21.00.

It is important the investors use tools such as the Warrant Selector to approximate their maximum holding period to increase their chances of making a potential return via warrants.

How does buying into an OCBC call warrant such as OAEW compare to trading in OCBC shares directly?

One can use Macquarie’s Exposure Simulator to compare the investment amount and performance differences between the two.

Source: Starting positive column on Exposure Simulator tool, https://www.warrants.com.sg/tools/exposuresimulator/OAEW

Assuming if one buys 5,000 OCBC shares at $19.00, that would require a capital outlay of $95,000 before costs. To replicate the $95,000 stock exposure via OCBC call warrant OAEW, however, one can invest with a lower capital outlay of $13,971 (i.e. buy 310,500 units at $0.045) instead.

Should OCBC gains 5.3% to $20.00, one would make absolute returns of $5,000 buying 5,000 OCBC shares, while OCBC call warrant OAEW would return $4,967 if OCBC makes the share price return in 18 days.

If OCBC takes four weeks to do so, the absolute profits from the OCBC warrant will dip below that of the direct investment in OCBC shares, although its percentage return of 31.1% will still be almost 6 times more than OCBC shares.

Investors may wish to note that using a OCBC call warrant will only allow you to participate in the share price move, and is not equivalent to investing and holding OCBC shares directly.

The sharing on how one can take a position using warrants has been contributed by Macquarie Warrants Singapore who is the issuer of these warrants listed on SGX.

About the Author - Joey Choy

Joey is Singapore’s renowned mentor on how to make an income by trading the stock market, an author and one of the most-watched, quoted and followed stock trading trainers in Singapore. Over the years, he has conducted numerous full house seminars, enriching thousands to trade more profitably.

Joey’s come back story from a S$740k debt has been featured in the Business Times and inspired thousands in Singapore. In less than 3 years, he is highly regarded as one of the Top Tier Remisiers (Stock Brokers) and Traders, bagging numerous yearly awards like Top Trading Representative and Top CFD Achiever every year from 2014 to 2023 in Phillip Securities.

More about Joey here

Hope you have found the above content useful 😃

If you are keen to find out more on how to be a VIP Client of mine to receive daily market updates and exclusive actionable stock ideas, you can check it out here!

Look forward to see you on the inside!

- Joey